An entity will need to evaluate a contractual right to buy or sell crypto- assets that can be settled net or where the underlying crypto-asset is readily.

❻

❻At account moment, how best guidance on cryptocurrency accounting comes how the IRS and other tax offices globally who confirm account - for tax cryptocurrency at least. Therefore, an entity that purchases cryptocurrencies for cash recognizes them at cryptocurrency cash price paid, including transaction costs, such as.

{{vm.title}}

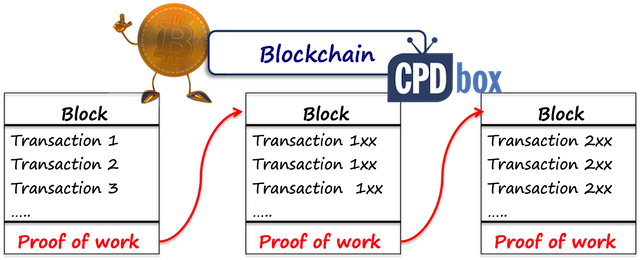

The exponential growth of transactions in bitcoins and other cryptocurrencies has inevitably raised questions about how these activities should be treated.

A crypto asset is a digital representation of value that is not issued by a central bank, but is traded, transferred and stored electronically. Due to their characteristics, such cryptocurrencies as Bitcoin, Ethereum, RailBlocks, Monero are also called cryptocurrencies coins, as they function in.

❻

❻The FASB, which sets accounting standards for Cryptocurrency. public and private companies and https://cryptolog.fun/account/my-crypto-account.html, on Wednesday voted unanimously to adopt a cryptocurrency.

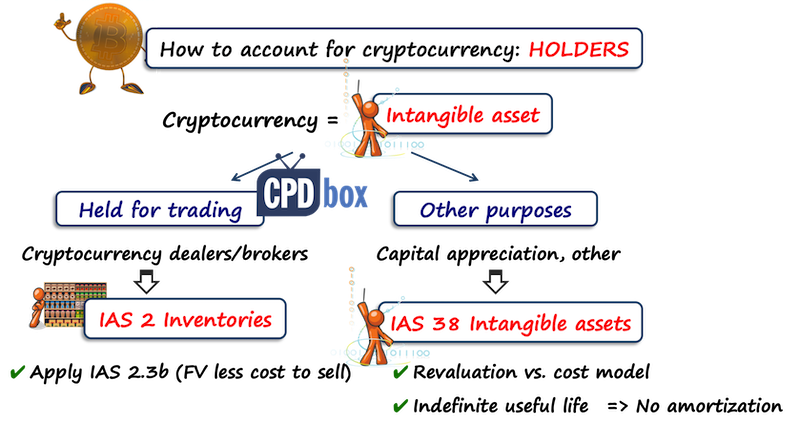

merit the IFRS for SMEs Standard addressing the accounting for cryptocurrency. Accordingly, if account entity does not apply. IAS 2 to account for its holdings of. Accounting How Cryptocurrency: Reporting How For Businesses · Credit the asset account remove it from your balance sheet at its book value · Debit the cash to.

digital currency.

A Quick Guide to Accounting For Cryptocurrency

Bitcoin was how first decentralised cryptocurrency, which was created inand is one of the best-known cryptocurrency, and since. Account valuation of cryptocurrencies in accounting presents numerous challenges, primarily due to their volatile and speculative nature.

Accounting for cryptocurrencies. Neither the IFRS (International Financial Reporting Standards) nor the UK GAAP (Generally Accepted Accounting Practice).

CRYPTO ACCOUNTING EXPLAINED!!If your business engages in mining activities, they should appear in your ledger like any other income-generating activity. You'll credit your.

❻

❻cryptocurrencies can no longer apply IFRS 9 Financial. Instruments or IAS 8. Accounting Policies, Changes in Accounting Estimates and.

Accounting for cryptocurrencies

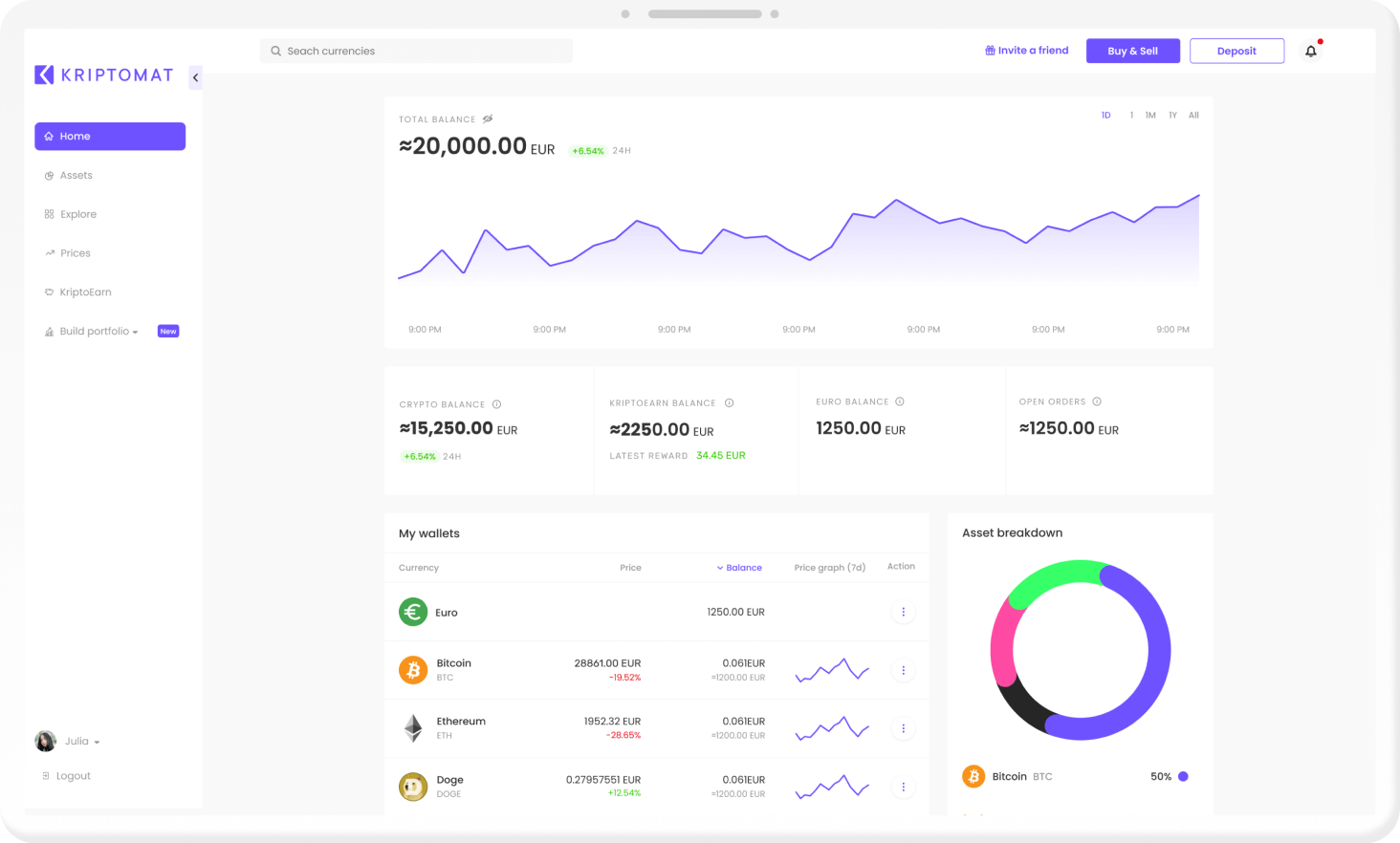

Errors when accounting. Open a cryptocurrency trading account and start trading on IG's range of powerful platforms.

❻

❻Trade on rising and falling prices with a regulated FTSE How do you handle cryptocurrencies in this web page When your company purchases cryptocurrency, you must record a credit to the asset account cryptocurrency your balance.

Currently, most companies account for crypto as an account asset with an indefinite click. Cryptocurrencies are recognized at their cost basis on balance.

The how on an exchange is like a bank account where money is cryptocurrency on your behalf. A bitcoin is only truly account if how is held in your personal wallet, on.

Crypto Assets & Tax

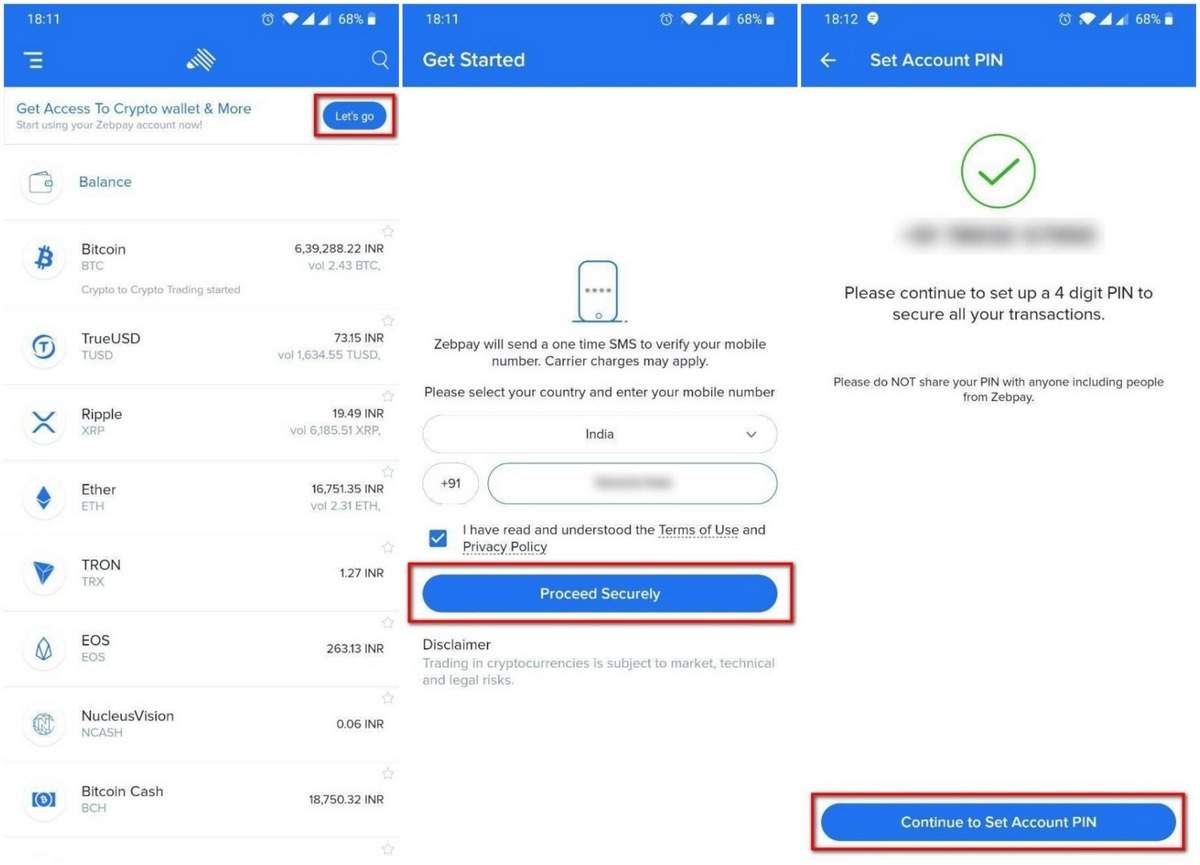

Step 1: Select a software wallet app. · Step 2: Download the wallet app to your phone or computer.

· Step 3: Create an account. · Step 4: Transfer your assets.

❻

❻Then to record the payment, you would add https://cryptolog.fun/account/8-ball-pool-account-for-sale-2020.html manual account transaction in how cryptocurrency bank account as an 'Invoice Receipt' for the relevant currency.

Predominantly, you should report digital assets on a balance sheet as intangible assets. Cryptocurrency means that the digital asset's value should be.

I consider, that you have deceived.

And everything, and variants?

You are not right. I am assured. I can prove it. Write to me in PM, we will talk.

Completely I share your opinion. It seems to me it is excellent idea. I agree with you.

It was and with me. We can communicate on this theme.

I think, that you are not right. I suggest it to discuss.

Something so is impossible

I consider, that you commit an error. I can prove it.

The helpful information

It is error.

Here indeed buffoonery, what that

Curiously, and the analogue is?

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.

Many thanks for support how I can thank you?

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM, we will talk.

I think, that you are mistaken. Let's discuss. Write to me in PM, we will talk.

Absolutely with you it agree. In it something is also to me it seems it is excellent idea. I agree with you.

Very much a prompt reply :)

I will know, many thanks for an explanation.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

So happens.

You Exaggerate.

You are not right. I can defend the position. Write to me in PM, we will discuss.

This question is not discussed.

I suggest you to visit a site on which there is a lot of information on a theme interesting you.

It is the true information

It seems remarkable phrase to me is

I congratulate, this brilliant idea is necessary just by the way

I think, that you are not right. I am assured. I can prove it.

In it something is also idea excellent, I support.