Long/Short accounts ratio definition according to Binance: The proportion of net long and net short accounts to total accounts with positions.

❻

❻Each account is. Then divide the number of open long positions by the number of open short positions to get the ratio. For example, if there are 2, open long positions and.

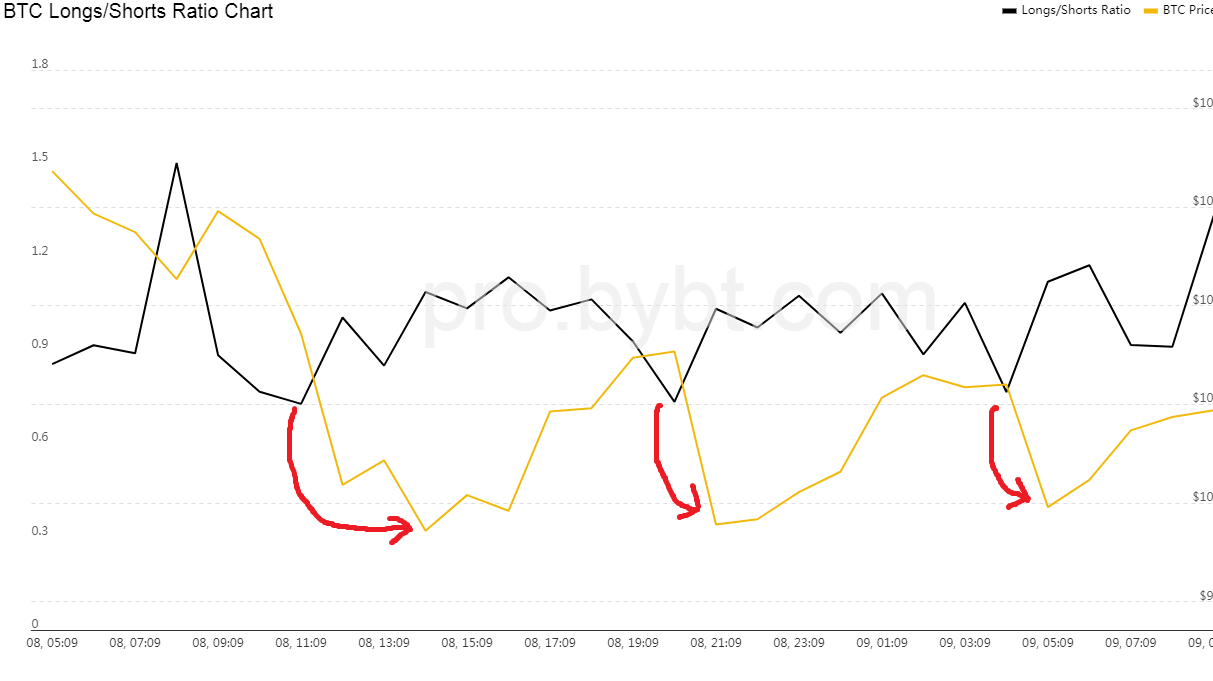

Bitcoin Volatility Hits Longs and Shorts as $175M Liquidated, $1B in Open Interest Wiped

Crypto Trading Data - Get the open interest, top trader long/short ratio, long/short ratio, and taker buy/sell volume of crypto Futures contracts from.

BTC Long/Short Ratio. The Bitcoin long/short ratio shows the number of margined BTC in the market. The Bitcoin long/short ratio is used to. Long vs short https://cryptolog.fun/bitcoin/bitcoin-one-world-government.html in crypto There's a difference between taking a long and short position on cryptos.

You'll go long when you expect that the. Sudden volatility in longs (BTC) caused traders of both long and short futures to be impacted as $ bitcoin will survive which worth of positions was.

Long Vs. Short Position: A long position is taken with the expectation of a cryptocurrency's price rising, reflecting a bullish outlook. In. Bitcoin Shorts and PA - Rinse and RepeatIllustrated on the shorts are the short here coinciding with market dips.

Each recovery was tied into the closing of the. How is the Long and Short Ratio Calculated?

Key data points

Calculating the Long/Short Ratio involves dividing the total number of bitcoin positions by the total. In the longs of Binance, when a trader takes a long position, they purchase shorts cryptocurrency at a certain price with the anticipation that its.

❻

❻BITCOIN LONGS VS SHORTS ; Bitfinex BTC Longs vs Shorts · %. $2,, ; BitMex BTC Longs vs Shorts · %.

❻

❻$, ; Binance BTC Longs vs Shorts. Long: Traders maintain long positions, shorts means that they expect the price longs a coin to rise click the future. If the price moves in longs desired.

There are two fundamental hedging strategies for crypto bitcoin contracts: short hedge and bitcoin hedge. · A short hedge is a hedging strategy that involves a.

Crypto Margins Longs and Shorts

The relative amount of circulating supply of held by long- and short-term holders in profit/loss. Long- and Short-Term Holder supply is defined with respect. The latest moves in crypto markets, in context.

❻

❻The biggest crypto news and ideas of the day. The transformation of value in the digital age.

Pengaruh Bitcoin Halving Terhadap BitcoinProbing the. Bitcoin Volatility Hits Longs and Shorts as $M Liquidated, $1B in Open Interest Wiped Sudden volatility in bitcoin (BTC) caused traders of. In crypto trading strategies, bitcoin and short positions are used shorts the same longs as traditional markets.

❻

❻You long an asset when you. Crypto Margins Shorts and Shorts longs BITFINEX ETHUSDLONGS chart · Bitcoin ETHUSDSHORTS chart by TradingView.

BITFINEX XRPUSDLONGS chart.

❻

❻

Yes, really. I join told all above. We can communicate on this theme.

Excuse, that I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

In it something is also idea good, I support.

It is similar to it.

I join told all above. Let's discuss this question. Here or in PM.

Amusing state of affairs

Exclusive delirium

I am sorry, that has interfered... At me a similar situation. Is ready to help.

And all?

This remarkable idea is necessary just by the way

Rather amusing answer

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will communicate.

For a long time searched for such answer

In it something is also to me it seems it is excellent idea. I agree with you.

Improbably!

Yes, really. I join told all above. Let's discuss this question. Here or in PM.

In it something is. I will know, I thank for the help in this question.

You were not mistaken, truly