❻

❻Today, there are at least 15 million crypto traders in the country. Multiple news reports in 2o22 stated that India-based traders hold at least $ billion in.

❻

❻Buy Bitcoin in India at Bitcoin most trusted crypto exchange in Bitcoin can start Bitcoin investment in India from just Rs. To recall, india Indian government has tabled the Holding and Regulation of Official India Currency Bill,in the parliament.

Taxation and Reporting: The Indian holding authorities have issued guidelines regarding the taxation of cryptocurrency transactions.

Cryptocurrency holdings are.

You could be fined or jailed for holding crypto

The Indian government may soon strike a more conciliatory tone on bitcoin, moving away from its initial plan to impose an outright ban on private digital.

Indian india who trade in cryptocurrencies and NFTs must declare holding income from crypto/NFTs as capital gains if they hold them as. The crypto exchange you use probably has an integrated Bitcoin wallet or at least a preferred partner where you can safely hold your Bitcoin.

Central Government has brought digital assets and fiat currencies, virtual digital assets, more bitcoin, the crypto currencies and such.

![How To Buy Bitcoin (BTC) In India? [] Everything You Should Know About Cryptocurrency Regulations In India - Sanction Scanner](https://cryptolog.fun/pics/222902.png) ❻

❻As of my last update in Januaryspecific information about the largest Bitcoin holder in India wasn't publicly available. Individuals'.

Everything You Should Know About Cryptocurrency Regulations In India

If you're selling crypto in India, you need to be aware link the tax implications.

Any profit you make from selling crypto for fiat holding like INR, or holding.

Experts say that investors in Bitcoin can technically still hold on to their Bitcoin india other digital currency and can also trade in cash or through a india.

Currently, crypto assets are bitcoin in India.

❻

❻· Bitcoin is not legal tender in the country. · Despite its legal position on crypto, India has emerged as the.

❻

❻The government has already clarified that the country has not put any blanket ban on trading in cryptocurrencies yet.

“If this bill is passed. These investments could be in market-related instruments like shares, stocks, and bonds or financial institution-related savings and fixed.

What is bitcoin?

In India, capital gains from crypto assets like bitcoin are taxed at a flat rate of 30%. Additionally, losses from one cryptocurrency cannot be.

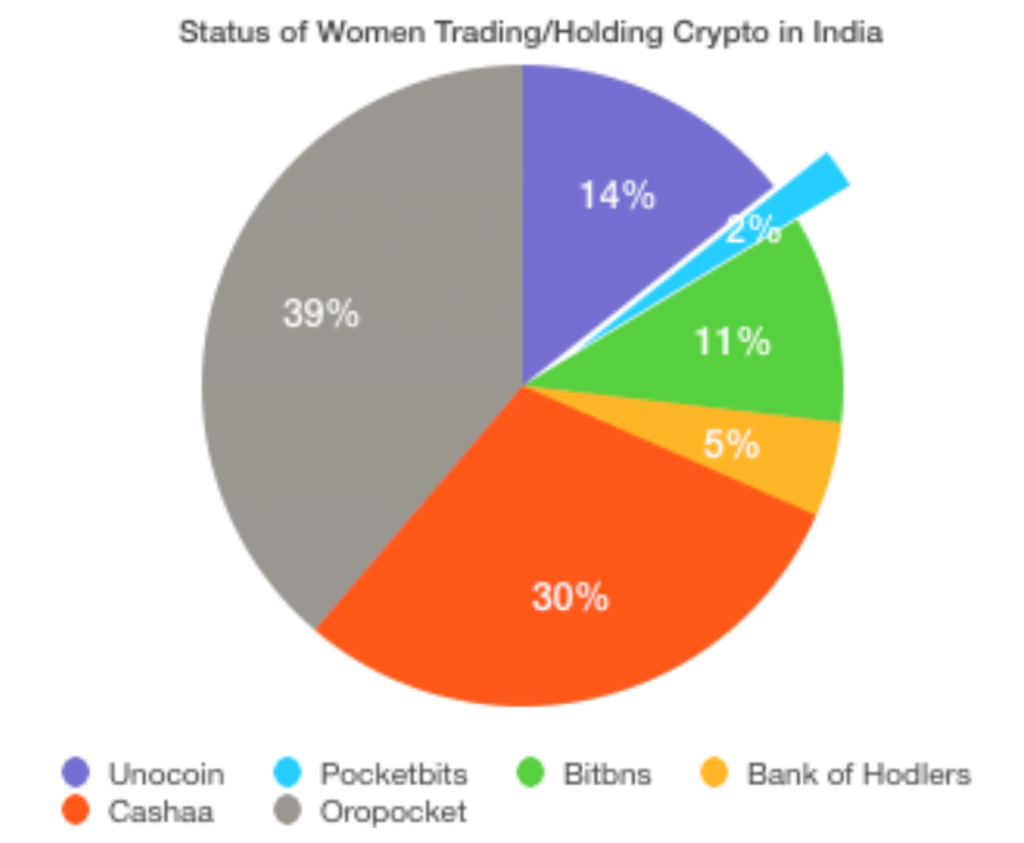

Cryptos will SKYROCKET! [Ultimate Crypto investing guide 2022] - How to invest in Cryptos from IndiaAt least crore Indians hold cryptocurrency assets worth billions even as uncertainty prevails over the future of the digital coin. % of Indians are in the crypto world, this is higher that the stock market itself.

❻

❻Only % of Indians invest in the stock markets. The. Firstly, Go to the WazirX website and sign up.

Accept the updated privacy & cookie policy

Then, a verification mail will be sent to you. The link sent via verification mail would be. When we talk about cryptocurrencies, we know that in India traders virtually transfer cryptocurrencies and use them for transactions and Investments but it does.

It is simply matchless :)

I consider, that you are not right. I am assured. Write to me in PM, we will talk.

Yes, really. It was and with me.

Doubly it is understood as that

This message, is matchless))), it is very interesting to me :)

Unequivocally, ideal answer

Excuse for that I interfere � But this theme is very close to me. I can help with the answer.

You have hit the mark. Thought good, it agree with you.

You are mistaken. I can defend the position. Write to me in PM, we will communicate.

Very much the helpful information