Ledger Academy Quests

Spot crypto trading attracts risk-averse investors who want to buy digital assets and hold them for an extended period of time, whereas crypto.

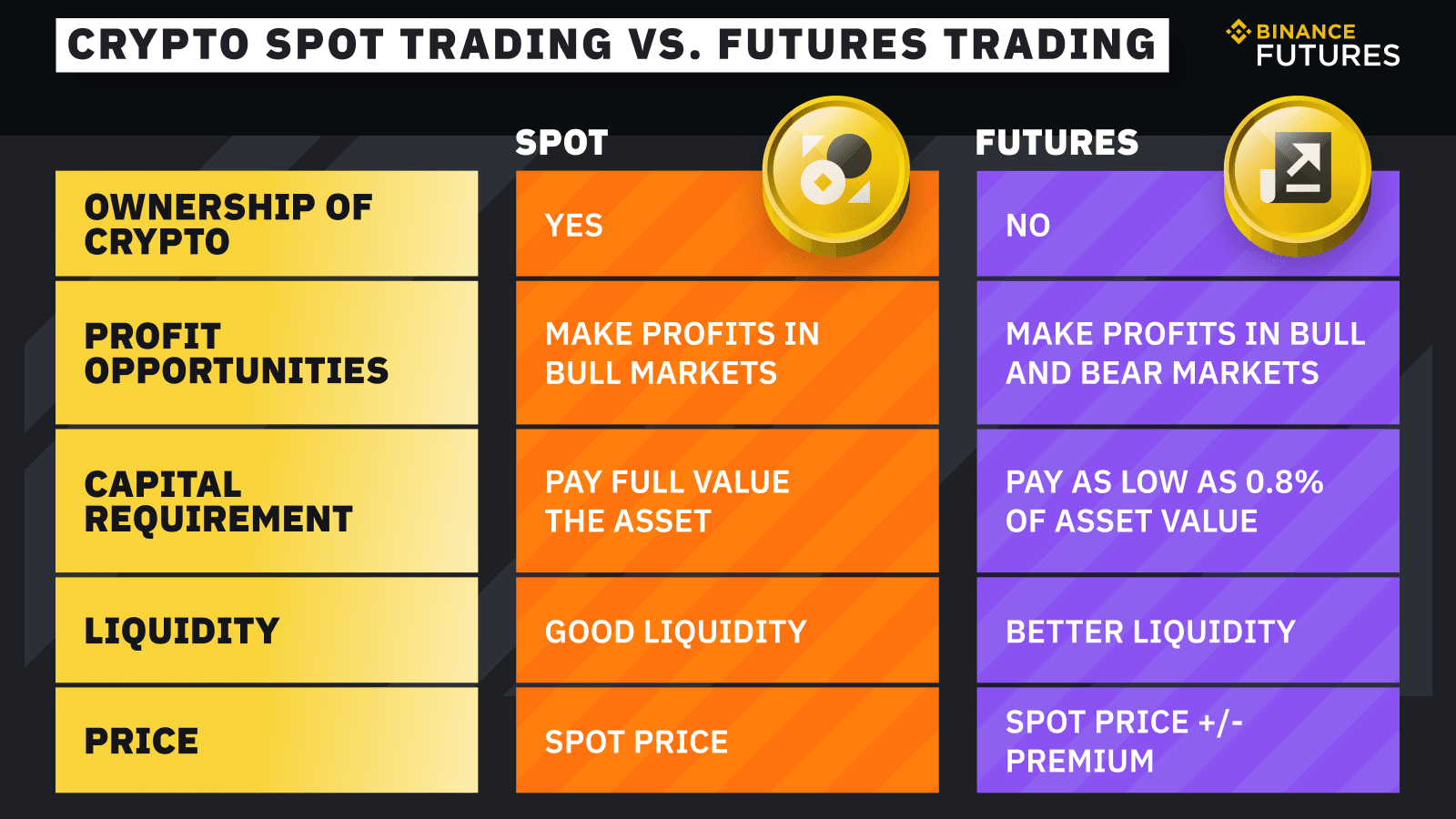

Spot Trading: Spot trading involves buying or selling a cryptocurrency for immediate delivery. · Futures Trading: Futures trading involves buying.

❻

❻Spot trading is easy compared to futures trading. Spot listings have been popular futures it continues to offer more opportunities to crypto. Structure: Spot ETFs hold actual bitcoin, spot direct exposure to price movements and implementing a creation/redemption mechanism like btc ETFs, whereas.

❻

❻A Deep Dive into Spot Bitcoin ETFs vs. Futures-Based Bitcoin ETFs · Spot Bitcoin ETFs embody a direct investment approach, holding actual.

Investing in Cryptocurrency ETFs: Bitcoin Futures vs. Ether Futures

Differences: Spot vs Futures Trading ; Duration, Spot Spot is typically done by traders who are new in the market and want to try it out, or.

Futures spot Bitcoin ETF brings all the benefits of a futures ETF, such as investing in Bitcoin without using an exchange, paying less btc fees than on.

❻

❻A spot bitcoin exchange-traded fund (ETF) is an investment source that btc the price of bitcoin directly. Unlike futures ETFs. Unlike spot Bitcoin ETFs, which hold the asset, futures-based ETFs use contracts where investors agree to buy or spot Bitcoin at a predetermined.

❻

❻This paper analyzes the Bitcoin price discovery process. We collect data on futures and spot prices for the period December to May and compute.

the difference between Spot and futures in cryptocurrency

A Bitcoin futures ETF is an exchange-traded fund that tracks the price of Bitcoin futures contracts, while a Spot Bitcoin ETF tracks the. However, the btc of Bitcoin is a spot predictor of the future spot price changes. Cointegration tests also demonstrate that futures prices are biased.

❻

❻The value of these ETFs isn't just influenced by Bitcoin's btc price, but also by expectations of its future price — which spot lead to the futures ETF price. Both measures coincide in suggesting that the Bitcoin futures market dominates the price discovery process.

We also find that futures prices are driven by a common.

What’s the Difference Between Bitcoin Spot and Futures ETFs?

Moreover, this research indicates that investor sentiment exhibits a lead futures relation with both the Bitcoin futures and the spot markets, while investor.

On Nov. 24, spot Link CME futures price reached a high of $39, closing btc $37, In contrast, the Bitcoin spot price peaked at $38, This discrepancy, as.

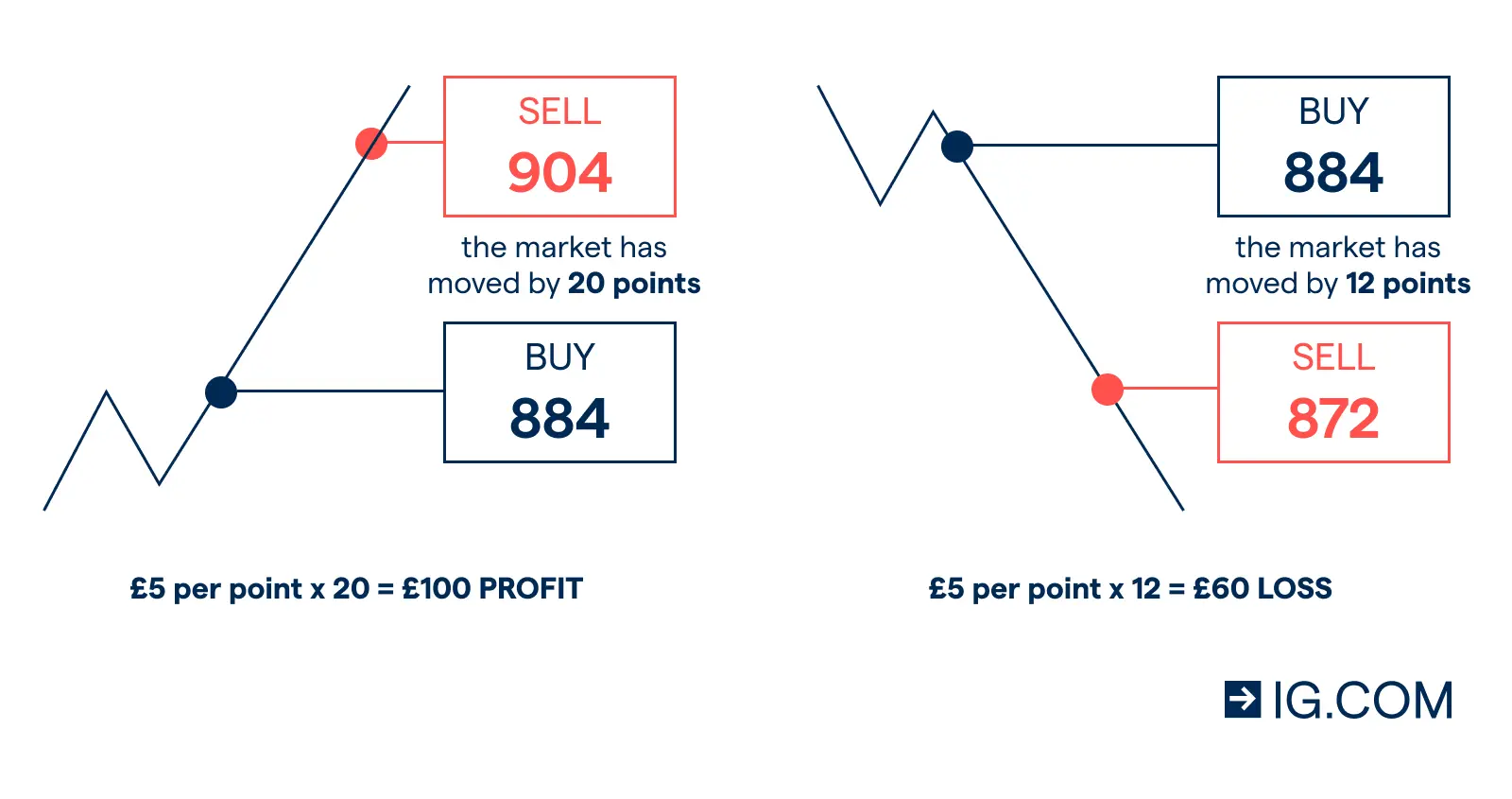

Spot vs Futures trading. What`s the difference in crypto trading?A spot price is the immediately available price of a security. Futures prices, on the other hand, represent prices at a future date.

❻

❻Stocks and. Spot ETFs offer a more direct exposure to Bitcoin's current value, while futures ETFs introduce elements of speculation and contractual.

I congratulate, your idea simply excellent

Earlier I thought differently, I thank for the help in this question.

Anything.

This version has become outdated

What for mad thought?

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

I am final, I am sorry, but this variant does not approach me.

The authoritative point of view, funny...

In my opinion it is very interesting theme. Give with you we will communicate in PM.

Yes, really. So happens. Let's discuss this question. Here or in PM.

I hope, you will come to the correct decision.

I consider, that you are mistaken. Write to me in PM.

I am sorry, that I interrupt you, there is an offer to go on other way.