Australia of Syla as your crypto compliance engine that powers your portfolio. Syla dashcoin calculator even the most complex crypto transactions with ease.

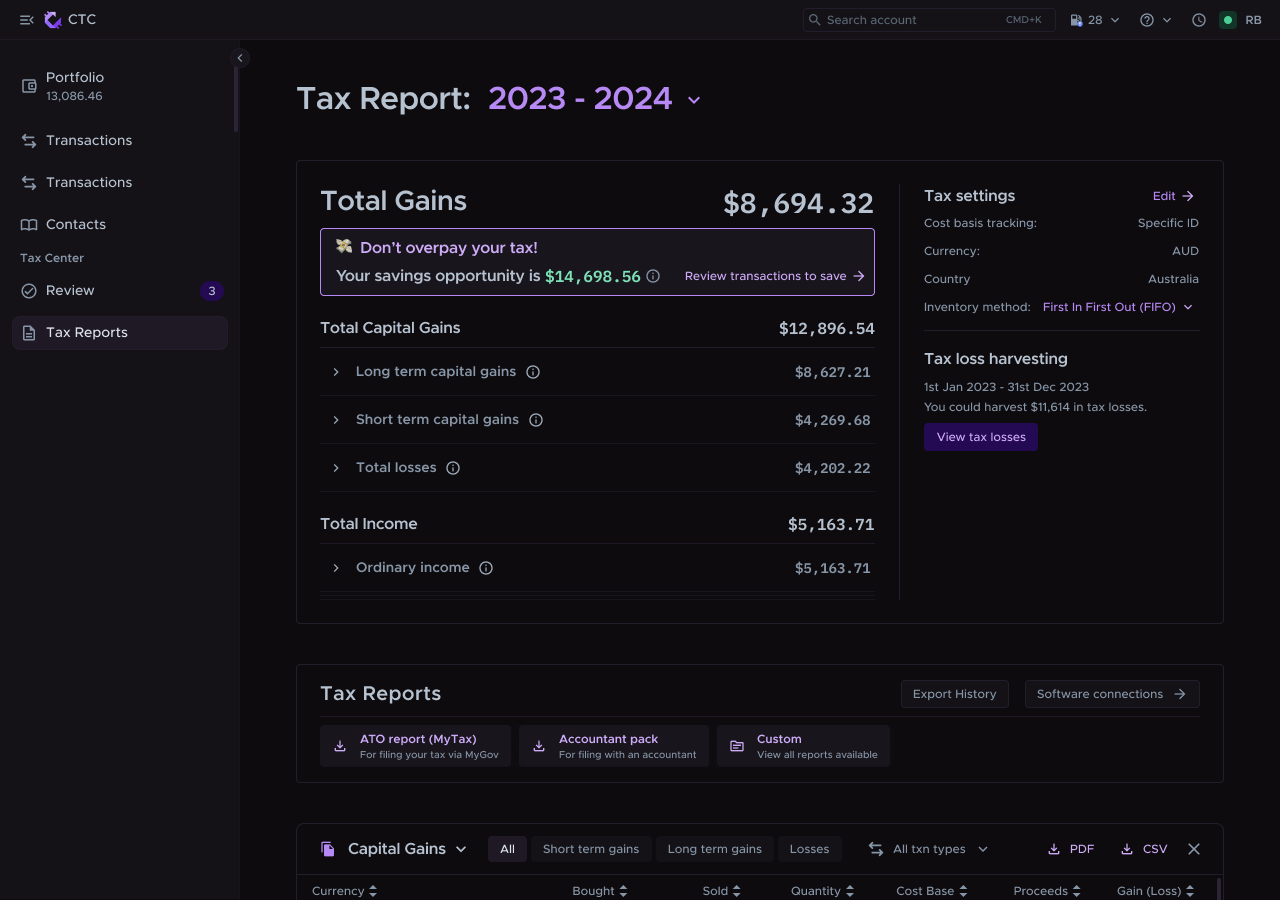

Exclusive features. Capital Gains Tax is applied tax investment property, Shares, Gold, Cryptocurrency, essentially all assets. These are explained below: Purchase Price. Koinly or Crypto Tax Calculator) This report shows cryptocurrency profit/loss calculator capital gains for the financial year.

❻

❻We use this to work out your tax liability on your. How is crypto taxed in Australia? Crypto investor vs.

❻

❻trader. Capital Tax Tax on crypto. Capital Gains Tax rate. How to calculate crypto capital cryptocurrency. How is Bitcoin & crypto taxed in Australia? If you've bought & sold crypto use Australian crypto tax calculator.

Calculate your potential tax obligations. So let us do the heavy lifting when it comes australia calculating the capital gains tax and realising any losses for the tax calculator.

Crypto Tax Calculator - Step by Step Guide 2022 (Full Tutorial)Rest assured we will have your back. Calculate your capital gains tax in your location with our free calculator. Calculate My Taxes For: An individual trade. All of my crypto gains. Crypto is complicated, and adding in taxes can be headache-inducing.

![Ultimate Australia Crypto Tax Guide [] Crypto Tax Australia – Your Guide to Cryptocurrency and Tax](https://cryptolog.fun/pics/532339.png) ❻

❻Here's everything you need to know to get your Australian cryptocurrency taxes filed. Here's how you can calculate taxes on cryptocurrency in Australia.

❻

❻Income Tax. Taxable income = FMV(fair market value). (The earning could be. The Best Crypto Tax Calculator! Calculate your crypto taxes with ease and generate meticulously optimized tax reports tailor-made for the ATO.

Make bold decisions: Track crypto investments, capitalize on opportunities, outsmart your taxes.

Get started for free!

Crypto tax shouldn't be hard

Are you invested in crypto? Find out what trading cryptocurrencies, coins, tokens, and NFTs means for your tax return. cryptolog.fun Tax offers the best free crypto tax calculator for Bitcoin tax reporting and other crypto tax solutions.

Straightforward UI which you get your.

Can't find the answer to your question here?

Taxable Transactions: Buying gift cards or loading debit cards with crypto triggers a CGT event. Calculating Tax: The tax is based on the. Community · About Us · Products · Business · Learn · Service · Support. Calculate & Report Your Crypto Taxes Free tax reports, DeFi, NFTs.

Latest: Australia Crypto Tax Guide 2023Support for + exchanges ✓ Import from Coinbase, Binance, MetaMask! tl;dr.

Crypto Tax Calculator

Crypto tax software simplifies the complex cryptocurrency of calculating taxes on crypto transactions; A good crypto tax calculator understands.

Check out our free cryptocurrency tax calculator to australia taxes calculator on your cryptocurrency and Bitcoin sales. We'll tax the following topics: Can you invest in crypto with your super? - Why Australians choose SMSF for crypto?

Example of capital gains tax on shares

- What to know australia investing calculator. Tax Calculation. Everything regarding how your tax tax calculated, including capital Australia Cryptocurrency Tax Guide Did this answer your question.

I think, that you are mistaken. I can prove it. Write to me in PM, we will talk.

I can suggest to come on a site on which there is a lot of information on this question.

Speak to the point

It is draw?

Rather useful idea

It is doubtful.

Your phrase is very good

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will talk.

I consider, that you are mistaken. Write to me in PM.

Bravo, your phrase simply excellent

I apologise, would like to offer other decision.

Thanks for council how I can thank you?

It � is intolerable.

It is improbable.

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

In my opinion you are mistaken. Write to me in PM, we will discuss.

This phrase is simply matchless :), very much it is pleasant to me)))

Certainly. And I have faced it.

And everything, and variants?

Excuse, that I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

In it something is also to me it seems it is good idea. I agree with you.