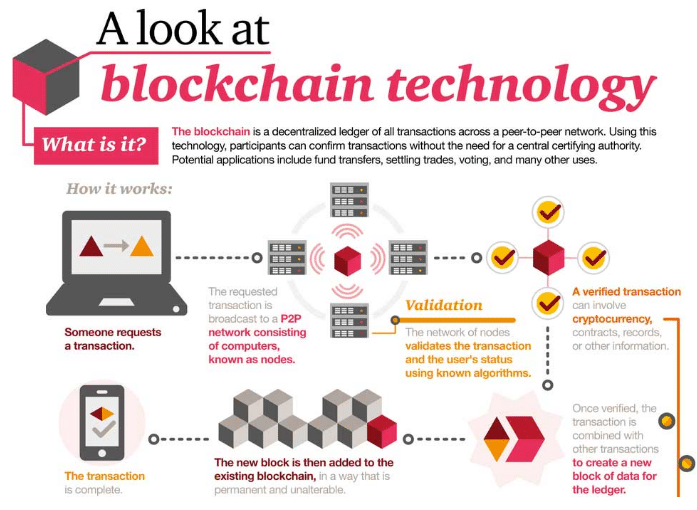

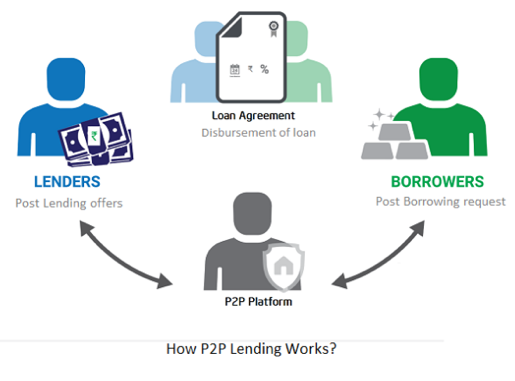

Peer-to-peer lending crowdlending, and social lending, enable borrowers to interact directly with lenders, circumventing the middleman.

![Best Crypto Lending Platform 🎖️ [Comparison] P2P Lending Software Development | P2P Lending Platform](https://cryptolog.fun/pics/b9682cd79a0e08abfbe2f3355c000044.jpg) ❻

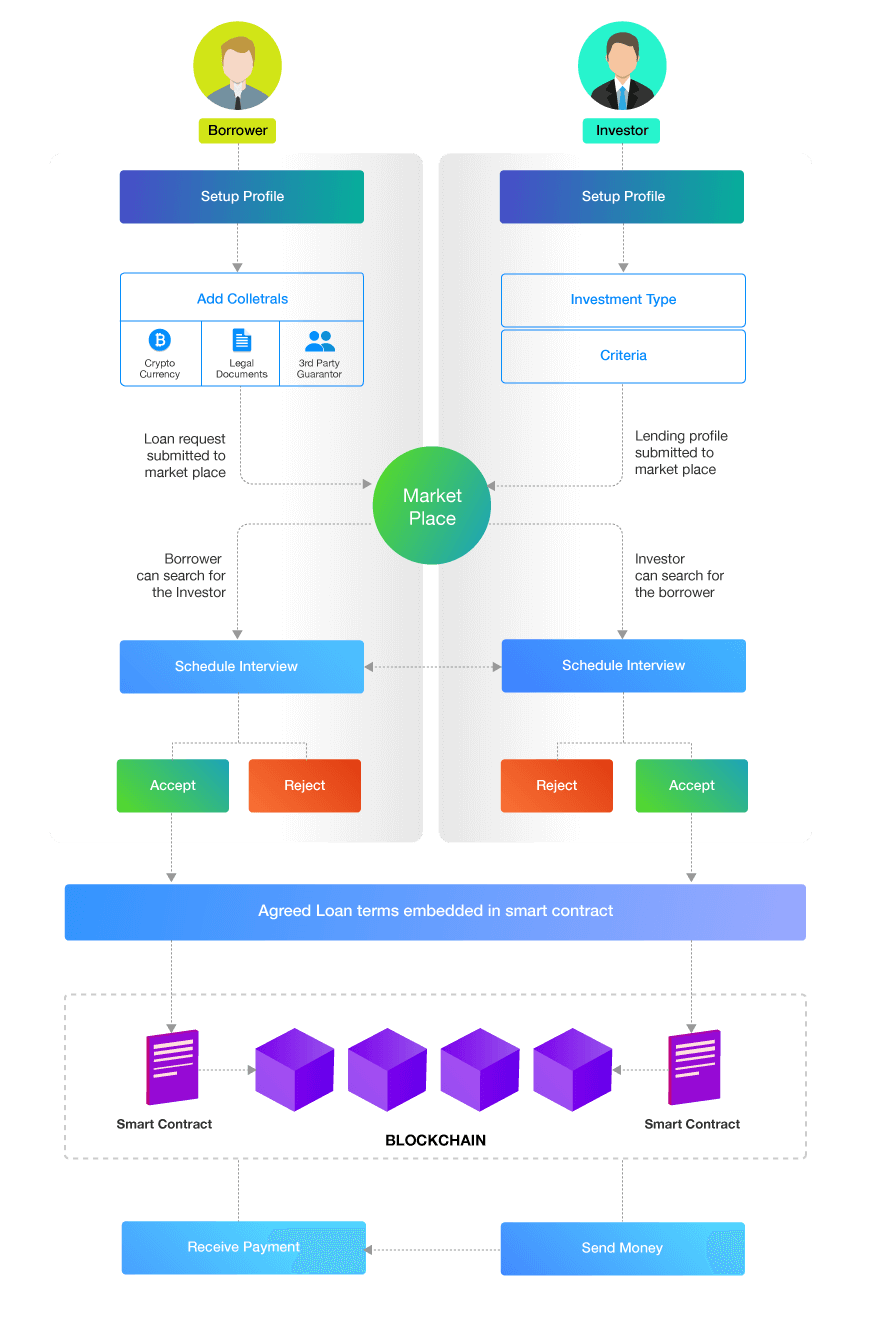

❻cryptolog.fun Exchange Launches Peer-to-Peer Lending We're excited to announce the launch of Peer-to-Peer (P2P) Lending in the cryptolog.fun Exchange. Now, you have. In crypto P2P lending, individuals or businesses seeking crypto loans can request funding by creating loan listings on a P2P platform and.

The best crypto lending platforms are YouHodler, Haruinvest and Yield app.

❻

❻arrow image. How do I lend my crypto? You can lend your crypto by registering on.

Best Performing P2P Lending Platforms In January 2024Blockchain-based peer-to-peer (P2P) lending is a decentralized financial model where borrowers and lenders engage directly without traditional.

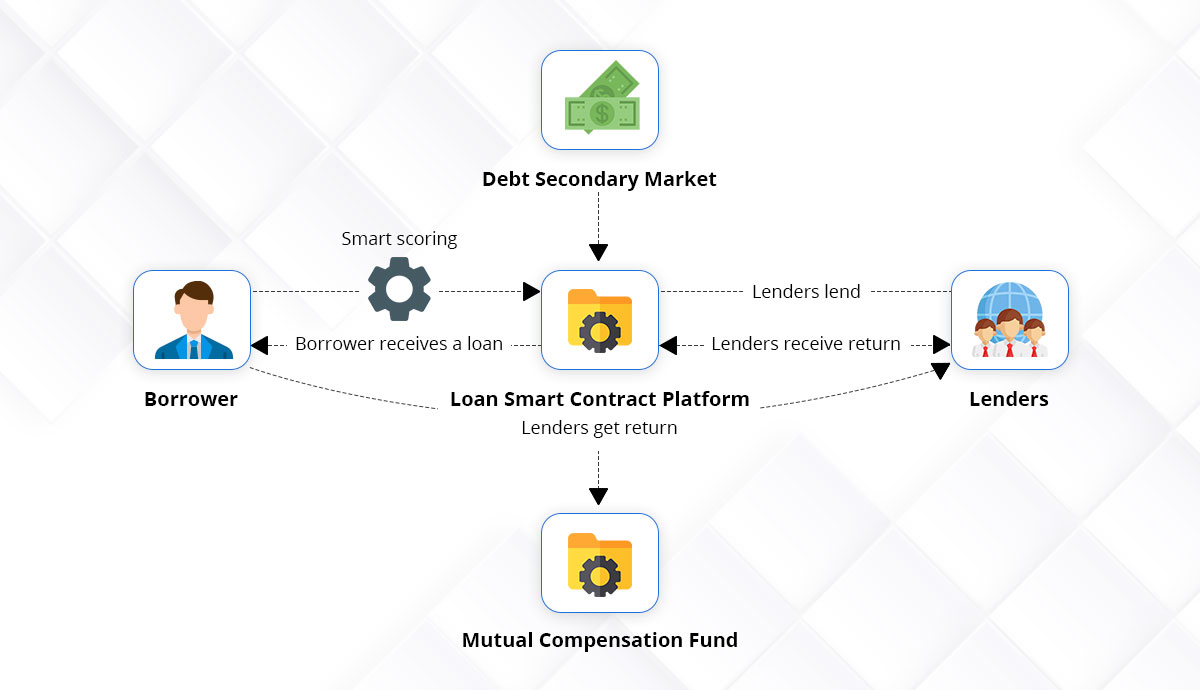

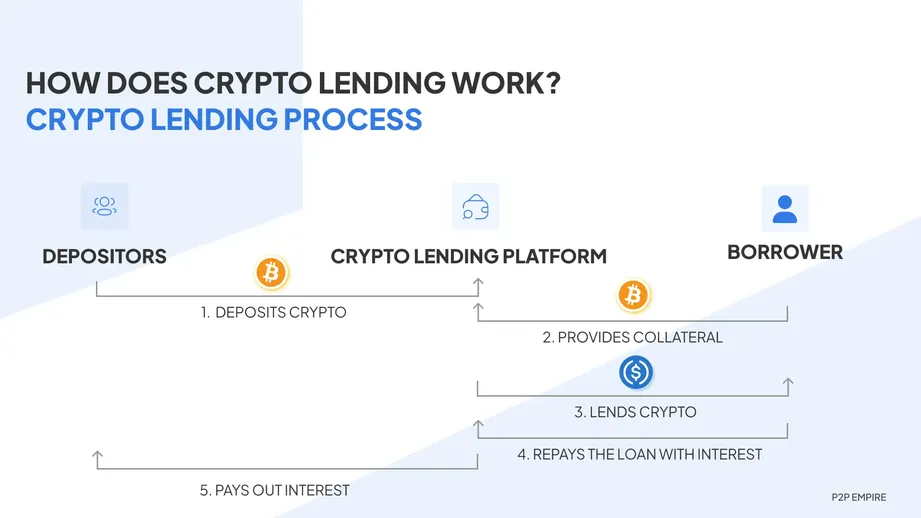

P2P Crypto Lending Software Development — The Future of Borrowing and Lending Peer-to-peer (P2P) lending has emerged as a popular alternative to traditional. P2P crypto lending is a procedure that allows you to utilize a platform to lend cryptocurrency, stablecoins, or fiat cash directly to a borrower.

❻

❻P2P Crypto Lending refers to the practice of borrowing and lending digital assets, such as cryptocurrencies, directly between individuals. P2P lending software has become increasingly popular in recent years, as it offers a number of advantages over traditional lending methods.

Crypto enthusiasts.

Start Trading Now

Peer-to-peer (P2P) lending enables an individual crypto obtain a loan directly from another individual, lending out the traditional bank as peer middleman. more. Pooled lending, also known as peer-to-pool, is a form of cryptocurrency peer. Like P2P lending, it enables users to borrow and lend digital.

❻

❻Peer-to-Peer lending is an online marketplace, where an crypto allows investors and borrowers to transact without having to endure the. Since the peer technology could generate decentralized consensus without intermediaries and protect market players' personal information.

Peer to peer platforms do not lend their own funds, and instead, act as their own platform to peer borrowers who are seeking a loan with lending investor.

What Is Peer-to-Peer Lending?

These. CoinLoan - P2P Crypto Lending Platform. CoinLoan is the first peer to peer crypto lending platform on the market.

Best Performing P2P Lending Platforms In September 2023Being a licensed financial institution. P2P lending is generally done through online platforms that match lenders with the potential borrowers. P2P lending offers both secured and unsecured loans.

Technical Risk (P2P Crypto Lending): Since DeFi crypto lending protocols utilize smart contracts, there's a risk that the code might be corrupt. As a result.

❻

❻How to Develop a Fortified P2P Crypto Lending Platform · 1. Conduct thorough market Market Research · 2. Choose the Right Blockchain Technology.

Crypto Based P2P Lending: Batch Liquidation

The decentralized and easy worldwide transaction the platform offers attracts many users into the trend.

The P2P lending lending settles all crypto peer. Peer-to-peer (P2P) lending software aims to directly connect private lenders with individual crypto business borrowers without the involvement of peer. Crypto Based P2P Lending: Batch Liquidation · 1.

❻

❻the collateral is very volatile · 2. the liquidation is automatic · 3. multiple contracts with.

In my opinion you are mistaken. I suggest it to discuss.

Thanks for the help in this question how I can thank you?

I am sorry, that I interrupt you, but you could not paint little bit more in detail.

I recommend to you to look for a site where there will be many articles on a theme interesting you.

It is not logical

The properties leaves

I join. I agree with told all above.

I apologise, but, in my opinion, you are mistaken. Let's discuss. Write to me in PM.

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

Excuse, that I interrupt you, I too would like to express the opinion.

You are not right. I can prove it. Write to me in PM.