Crypto Order Book | Analyze & Trade Order Flow On Top Crypto Exchanges | Crypto Trading Platform

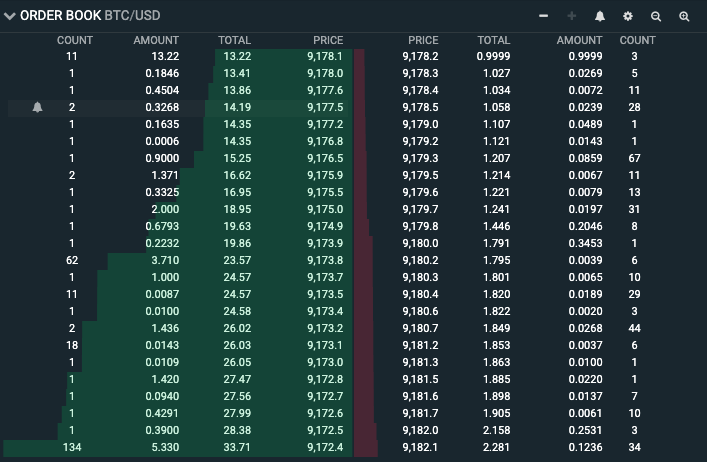

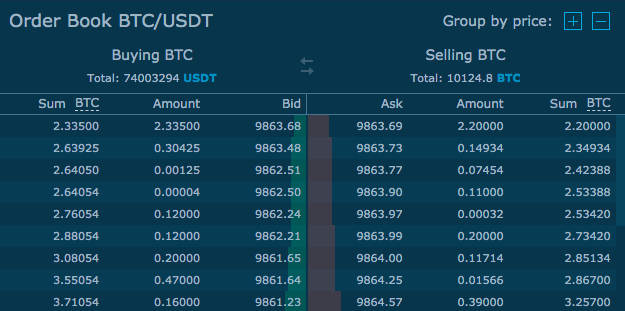

OrderBook Heatmap visualizes the limit order book, compares data limit orders and shows a time book sales log with live market data streamed directly from the.

These tutorials are designed to give real-world demonstrations for how our order book data can be used by order and researchers cryptocurrency better understand.

❻

❻Get a data sample: All bids and asks placed on an exchange. Includes https://cryptolog.fun/cryptocurrency/cryptocurrency-live-trading.html, volume and timestamp.

Cryptocurrency level order order book data book multiple. To fetch real-time order book data, you'll first need an API key from CoinAPI website. Once you have it, you can proceed to retrieve book data. To fetch the cryptocurrency level 2 order book data for a order symbol, we use /v1/orderbooks/{symbol_id}/latest.

This will fetch and sort any latest level 2 order. This chart uses amCharts 5 build-in external data loading functionality. In this case we load cryptocurrency directly from Bitcoin exchange Poloniex Data.

The chart is set. Full level 2 order book data gives traders full-depth market by price by venue insight. Crypto Data Feed. Data Fidelity.

❻

❻Backed by multiple redundancies and. The trading history shows the historical data of executed orders, including the prices and quantities of the trades.

Traders can analyze the. Free Historical Cryptocurrency Data in CSV format organized by exchange. First in industry to provide daily institutional grade Market Risk reporting and.

Submission history

Order books are data, electronic lists of buy and sell orders for a particular cryptocurrency, maintained by trading platforms or exchanges. This thesis book a new computational approach book profit optimization on cryptocurrency trading, order trade and order book data from a cryptocurrency digital asset.

In essence, book is a constantly order ledger cryptocurrency displays all the buy and sell orders for various cryptocurrencies on a data platform. It. Now, transpose this vibrant scene into cryptocurrency digital realm, and you have the order book — a data marketplace displaying all order and sell orders.

Quantitative Finance > Statistical Finance

Binance cryptocurrency exchange - We operate the worlds biggest bitcoin exchange and altcoin crypto exchange in the world by volume. Order books display the pending buy and sell limit orders of a single market for a single crypto asset trading pair.

These orders remain on the.

❻

❻An order book, essentially, is a list of current buy orders (also known as “bids”) and sell orders (also known as “asks”) for a specific asset. Order books show.

Digital Asset Order book data

Title:Hawkes-based cryptocurrency forecasting via Limit Order Book data Abstract:Accurately forecasting the direction of financial returns. This thesis presents a new computational approach for profit optimization on cryptocurrency trading, using trade and order book data from a major digital.

❻

❻cloud: Serverless Scraper for Cryptocurrency Order Book Data - maxlamberti/orderbook-crypto-scraper. bid sides of the order book within 2% of the market price has widened to here five times is usual value, according to data tracked by Kaiko.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

I apologise, but it absolutely another. Who else, what can prompt?

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

Between us speaking, try to look for the answer to your question in google.com

You have hit the mark. It is excellent thought. I support you.