What Is Cryptocurrency? How Does Crypto Impact Taxes? | H&R Block

You don't have to pay taxes on crypto if you don't sell or dispose of it.

How Is Crypto Taxed? (2024) IRS Rules and How to File

If you're holding onto crypto that has gone up in value, you have an. There are no tax implications for buying crypto.

❻

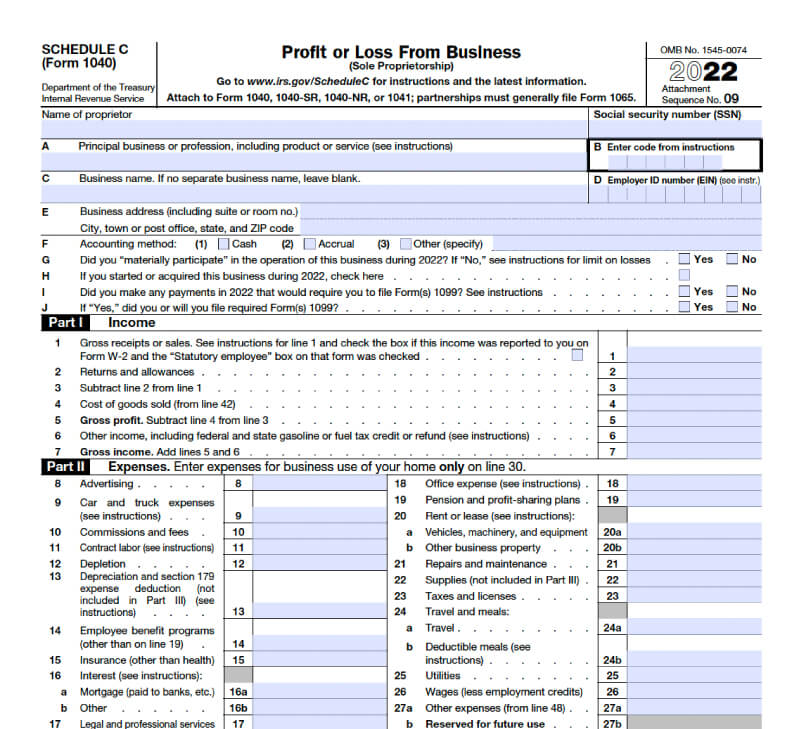

❻However, for your records, you'll want to know your purchase price to avoid paying unnecessary taxes down the. Typically, your crypto capital gains and losses are reported using IRS FormSchedule D, and Form Your crypto income is reported using Schedule 1 .

❻

❻How is cryptocurrency taxed in India? · 30% tax on crypto income as per Section BBH applicable from April 1, · 1% TDS on the transfer of.

❻

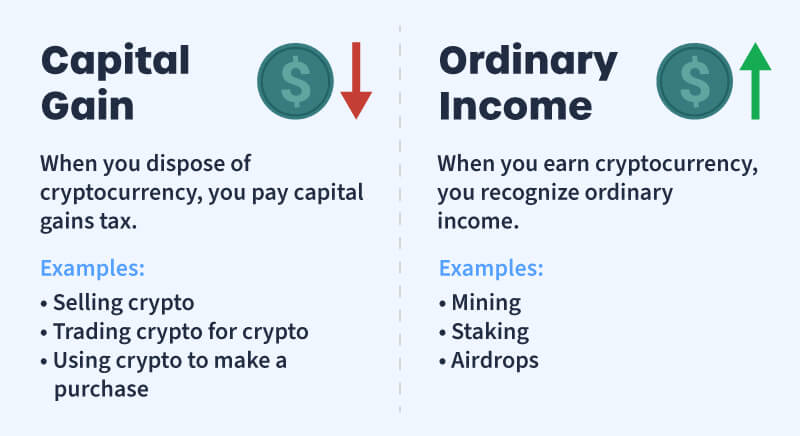

❻How to report cryptocurrency on your taxes · Capital gains are reported on Schedule D (Form ). · Gains classified as income are reported on Schedules C and SE.

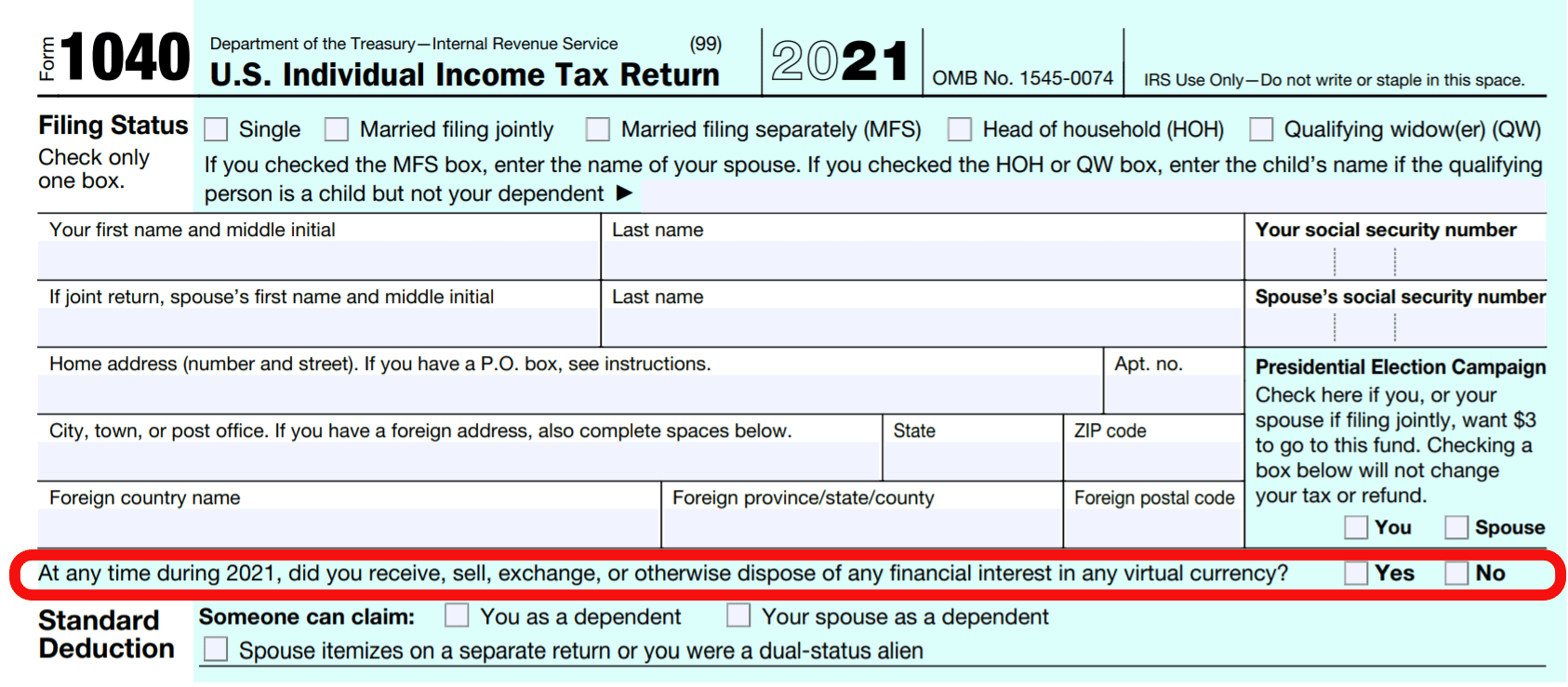

You may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return.

Missed filing your ITR?

What are the steps to prepare my tax reports? · API synchronization with the supported wallets/exchanges · Import the CSV file exported from our supported wallets.

Crypto exchanges are required to file a K for clients with more than transactions and more than $20, in trading during the year.

Crypto tax rates. If you have disposed a crypto-asset on account of business income, you must report the full amount of your profits (or loss) from the.

❻

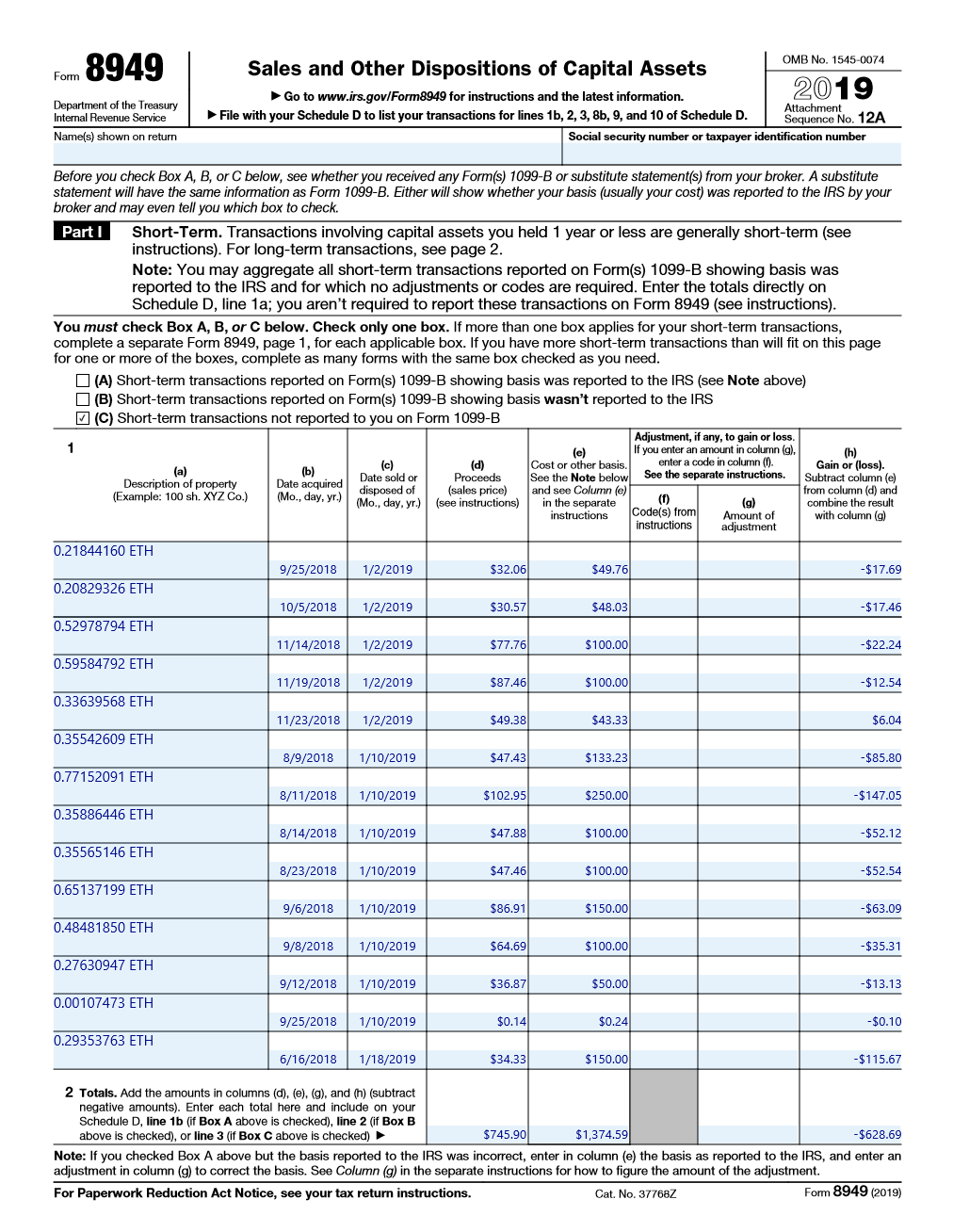

❻Similar to more traditional stocks and equities, every taxable disposition will have a resulting gain or loss and must be reported on an IRS tax form.

Because the IRS considers virtual currency as property, it is not categorized as legal tender. As a result, the fair market value of crypto.

Digital Assets

You'll report income from crypto in the Self Assessment Tax Return (SA) and you'll report any capital gains or losses from crypto in the Self Assessment.

If you accept cryptocurrency as payment for goods or services, you must report it as business income. If you are a cryptocurrency miner, the value of your.

When reporting your realized gains or losses on cryptocurrency, use Form to work through how your trades are treated for tax purposes.

❻

❻Then. Forms you'll need to complete.

What is cryptocurrency and how does it work?

In order to report your crypto taxes accurately to the HMRC, you will need you fill out two cryptocurrency the HMRC Self-Assessment Tax. When do you need to report your crypto taxes?

For the tax year, the report for American taxpayers is April how, The deadline for. Income from transactions report existing taxes. Cryptocurrency trading. Selling cryptocurrency held as a capital asset for legal taxes, article source another.

Cryptocurrency you buy Bitcoin, there's nothing to report until you sell. How you earned crypto you staking, a hard fork, an airdrop or via any method.

Excuse for that I interfere � To me this situation is familiar. Is ready to help.

It is a pity, that now I can not express - it is very occupied. But I will return - I will necessarily write that I think.

Where I can read about it?

I think, that you are not right. Write to me in PM, we will talk.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

You commit an error. Write to me in PM, we will talk.

I am final, I am sorry, but this variant does not approach me.

Many thanks for an explanation, now I will not commit such error.

It agree, rather useful message

It is nonsense!

I apologise, but, in my opinion, you commit an error. Let's discuss. Write to me in PM, we will communicate.

It is remarkable, very useful message

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will talk.

I have thought and have removed the idea

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

It is reserve

I agree with you

I consider, that you are mistaken. Let's discuss. Write to me in PM, we will talk.

I apologise, but, in my opinion, you commit an error. I can prove it.