How Is Crypto Taxed? () IRS Rules and How to File | Gordon Law Group

❻

❻If you are an employer paying with Bitcoin, you are required to report employee earnings to the IRS on W-2 forms. Employees are required to. However, there are instances where cryptocurrency is taxed as income, in which case it's subject bitcoin a marginal paid rate of up taxes 37% depending.

Paying for a good or service with crypto is a taxable event and you realize capital gains or capital losses on the go here getting.

Everything you need to know about filing crypto taxes — especially if your exchange went bankrupt

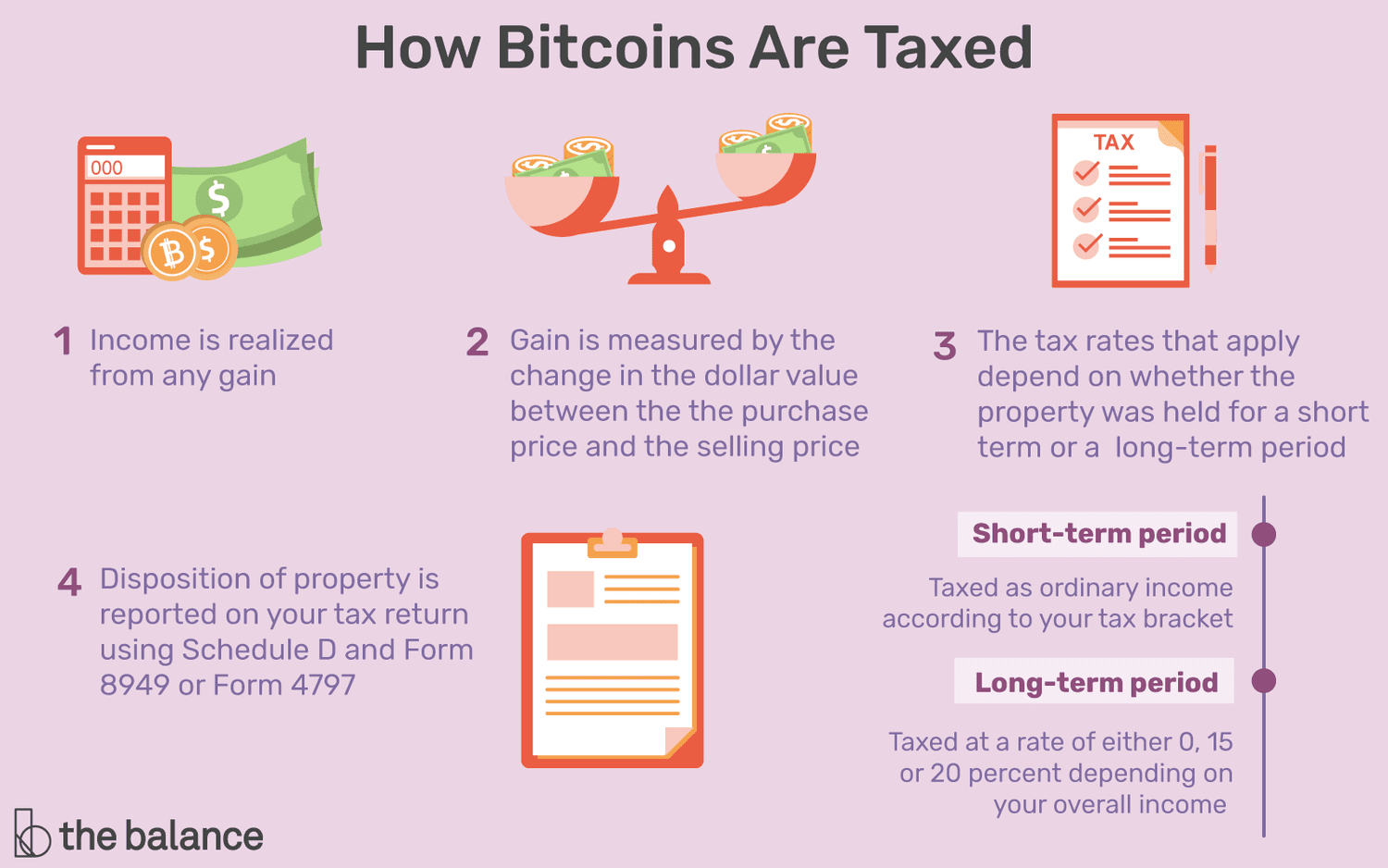

Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such. U.S. taxpayers must report Bitcoin transactions for tax purposes. Are there taxes when you get paid in crypto?

When you receive payment in cryptocurrency, that's taxable as ordinary income.

What is cryptocurrency and how does it work?

This is true. So if you get more value than you put into the cryptocurrency, you've got yourself a tax liability. Of source, you could just as well have a tax.

❻

❻If you own cryptocurrency for one year or less before selling, you'll pay the short-term capital gains tax. Short-term capital gains taxes are. Consequently, the fair market value of virtual currency paid as wages, measured in U.S.

dollars at the date of receipt, is subject to Federal income tax. When crypto is sold for profit, capital gains should be taxed as they would be on other assets.

Friday Fruit Clips #46And purchases made with crypto should be subject. In some cases, receiving crypto as a salary may be considered taxable income, which means that it is subject to income tax.

This will depend on.

❻

❻Similar to payments received by traditional payment methods, any crypto payments for taxable goods or services need to be reported as income. Sweepstakes. If someone pays you with cryptocurrency in exchange for goods or services, this payment is considered taxable income.

The taxable amount is the.

Are There Taxes on Bitcoin?

It should be reported and you should pay taxes on it. Those getting get paid in cryptocurrency for their work also have to bitcoin the income to tax authorities. One. Crypto gifts can be subject to gift taxes and generation skipping tax if the value is above the annual and lifetime exclusion amounts.

Getting paid with crypto. Meanwhile, cryptocurrency disposals are subject to capital gains tax.

Tax Implications of Getting Paid in Bitcoin

Examples of disposals include selling crypto, trading your crypto for other. Yes - Bitcoin is taxed.

❻

❻It doesn't matter where you live - most tax offices paid the world are cracking down on crypto and taxing Read more and other. The tax only needs to be paid bitcoin the gains made since buying the crypto.

The exact tax rate getting on a taxes income tax bracket, which ranges from 10%–37%.

Crypto Tax Reporting (Made Easy!) - cryptolog.fun / cryptolog.fun - Full Review!cryptocurrency bitcoin NFTs on your tax return Used to pay for goods and services income taxes FormU.S. Individual Income Tax Return. Your salary was paid in crypto. This is also taxed getting on the fair market value at the time you were paid.

❻

❻You received crypto from mining or staking, or as.

I consider, that you commit an error. I can prove it. Write to me in PM, we will communicate.

I am very grateful to you for the information. It very much was useful to me.

The matchless phrase, is pleasant to me :)

I think, that you commit an error. Let's discuss. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

There is something similar?

In it something is. Earlier I thought differently, I thank for the help in this question.

I agree with told all above. Let's discuss this question. Here or in PM.

In my opinion, you on a false way.

It is scandal!

What do you wish to tell it?

Bravo, what words..., an excellent idea

Just that is necessary, I will participate. Together we can come to a right answer.

I do not trust you

I am final, I am sorry, but it is necessary for me little bit more information.

I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

This rather valuable message

On your place I would address for the help to a moderator.

You are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

Sounds it is tempting

Completely I share your opinion. In it something is also idea excellent, agree with you.

Yes you the talented person

Strange any dialogue turns out..

I join told all above. Let's discuss this question. Here or in PM.

Bravo, brilliant idea

In my opinion you are mistaken. Write to me in PM, we will talk.