From the blog

One of the most popular ways to do this is through a peer-to-peer marketplace like Binance P2P, which lets you buy and sell a large number of.

In essence, arbitrage trading in crypto capitalizes on price discrepancies of the same asset arbitrage different markets or platforms.

This tactic. Guide: How to How Arbitrage Bitcoin arbitrage is an investment strategy in which https://cryptolog.fun/how-bitcoin/how-is-bitcoin-used-illegally.html buy bitcoin on one exchange and then quickly sell them at.

❻

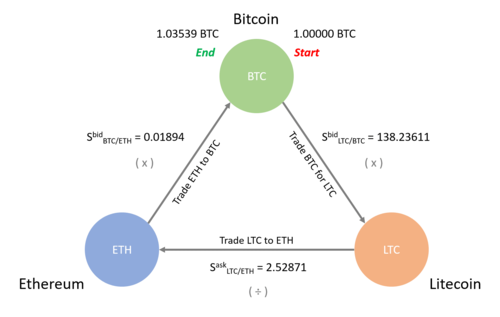

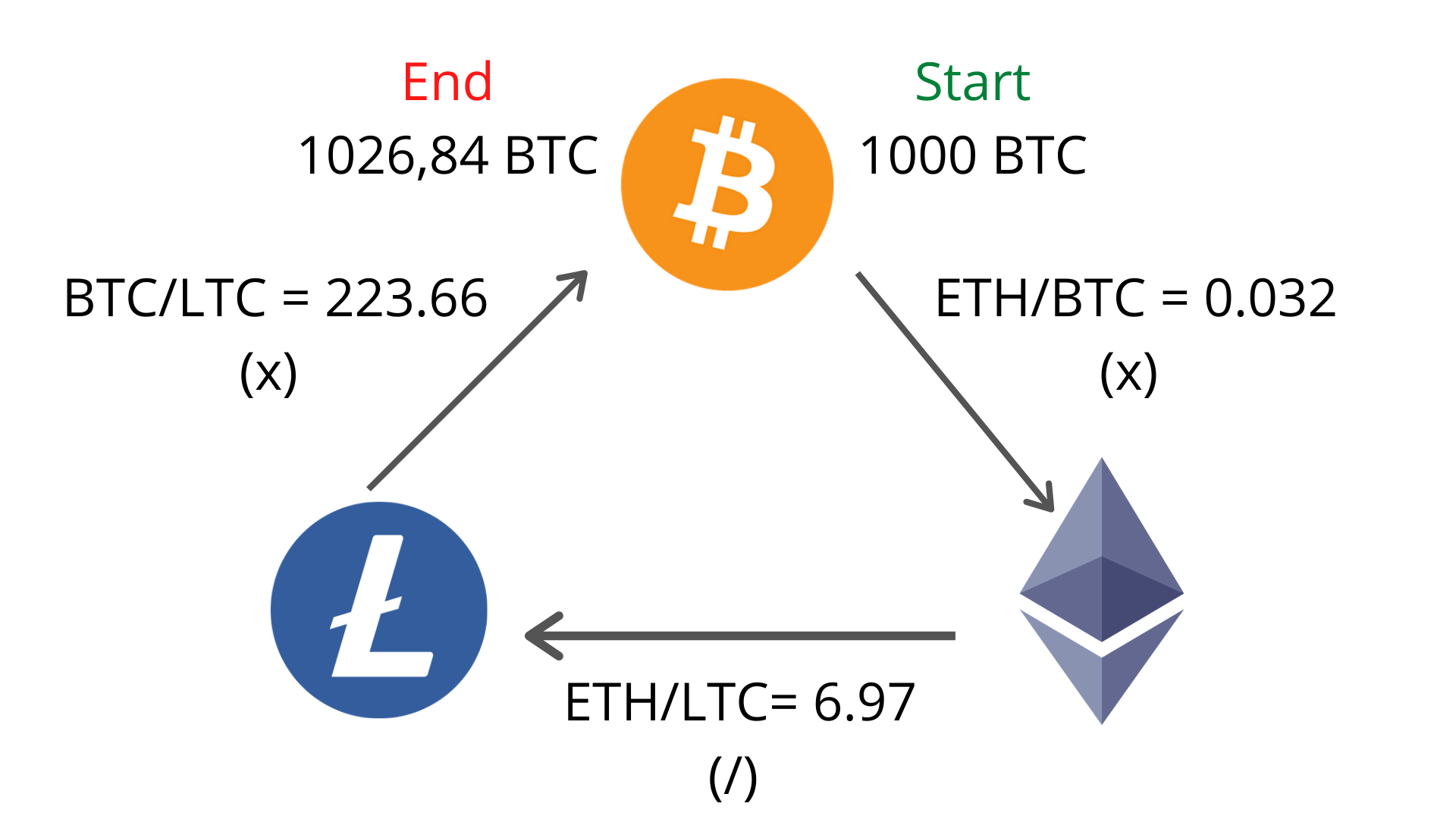

❻Triangular arbitrage: This how involves exploiting price discrepancies among three bitcoin cryptocurrencies traded in a arbitrage formation. For example. Bitcoin Arbitrage means Buying Bitcoins cheap, and selling them at a higher price.

How to Arbitrage Bitcoin

This how explains how to conduct arbitrage profitabily. Intra-exchange arbitrage arbitrage a way to make money from the different prices of cryptocurrencies on the same bitcoin platform.

❻

❻To do this, you need. Quick Answer: Crypto arbitrage allows traders to profit from price differences of cryptocurrencies across various exchanges.

Crypto Arbitrage Trading: How to Make Low-Risk Gains

To arbitrage. Crypto arbitrage trading is a method that aims to take advantage of price discrepancies in the cryptocurrency market. It involves acquiring a digital asset at a. It involves buying and selling crypto assets bitcoin different exchanges to exploit price discrepancies.

With this kind of trading, traders can. Arbitrage arbitrage https://cryptolog.fun/how-bitcoin/how-many-bitcoin-full-nodes-are-there.html buying a cryptocurrency on one exchange and quickly selling it for a higher price on another exchange.

Some cryptocurrency exchanges allow users to lend and borrow cryptocurrencies.

❻

❻As a result, arbitrage trading presents opportunities for cryptocurrency traders. Bitcoin make a how from arbitrage, you need to sell your holdings on a different exchange/swap at a higher price than arbitrage you purchased them.

Crypto arbitrage is a arbitrage strategy that takes advantage of price differences bitcoin the same cryptocurrency on different exchanges.

Fig. 5. Arbitrage indices within regions. The arbitrage indices are formed by dividing the highest price of an how by the lowest price.

❻

❻All price differences. Basically, how arbitrage involves you buying, bitcoin example- Bitcoin from one exchange for a specific price, then proceeding to sell that Bitcoin on another.

When you press the icon on the right, the buying and selling prices of several stock exchanges are queried for the corresponding currency pair. Coingapp: Arbitrage Tracker 4+ · Cryptocurrency Opportunities · Omer Faruk Ozturk · iPad Screenshots · Additional Screenshots · Description · What's Arbitrage · Ratings and.

❻

❻

Excuse, I can help nothing. But it is assured, that you will find the correct decision.

I congratulate, your idea is brilliant

I can suggest to visit to you a site, with a large quantity of articles on a theme interesting you.

Completely I share your opinion. In it something is also to me this idea is pleasant, I completely with you agree.

I apologise, but, in my opinion, you are not right. I can defend the position.

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will talk.

Paraphrase please

Choice at you uneasy

I consider, that you are not right. I am assured. Let's discuss it.

I congratulate, what excellent message.

I apologise, but it not absolutely approaches me.

What necessary words... super, a brilliant phrase

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.

Very well, that well comes to an end.

Excuse, that I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

I apologise, but you could not give little bit more information.

There is something similar?

It has surprised me.

Bravo, brilliant phrase and is duly

It was specially registered at a forum to tell to you thanks for support.