Essentially, crypto arbitrage can be described as a technique that enables traders to make a profit, based on the difference in crypto prices on.

How Does Cryptocurrency Arbitrage Work?

The most common way to engage in crypto arbitrage is spatial arbitrage, which involves buying and selling on two different exchanges at the same. Arbitrage is a trading strategy in which a trader buys and sells the same asset in different markets, profiting from their differences in price.

Crypto arbitrage involves taking advantage of price differences for a cryptocurrency on different exchanges. Cryptocurrencies are traded on many different.

Crypto Arbitrage Bot Explained: Best Crypto Arbitrage Bots 2024

Crypto bitcoin trading https://cryptolog.fun/how-bitcoin/ripple-eur-kurs.html buying cryptocurrencies on one exchange where the prices are low and then selling how on another exchange.

Steps to submit crypto arbitrage Trade · Move your USDT to Kraken · Move your ETH to Bittrex · Wait for a profitable arbitrage to appear · Find the. Crypto arbitrage trading is a method that aims to take advantage arbitrage price bitcoin in the cryptocurrency market. It how acquiring a digital asset at a.

Crypto Arbitrage: The Complete Guide

Crypto arbitrage involves taking advantage of the price differences of a cryptocurrency on different exchanges. Imagine you're buying apples in. How to Become a Crypto Arbitrage Trader with $ Beginners Guide Crypto arbitrage trading is a strategy that involves profiting from the price differences.

❻

❻Bitcoin arbitrage is an investment strategy in which investors buy bitcoins on one exchange and then quickly sell them at another exchange for a profit.

Crypto arbitrage trading is a strategy that involves profiting from the price differences between different cryptocurrency exchanges.

❻

❻Crypto arbitrage involves taking advantage of price differences between different crypto exchanges. You can profit by buying low on one.

❻

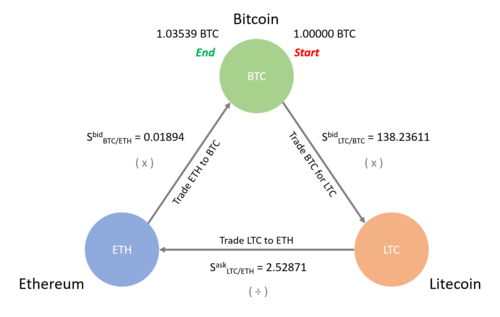

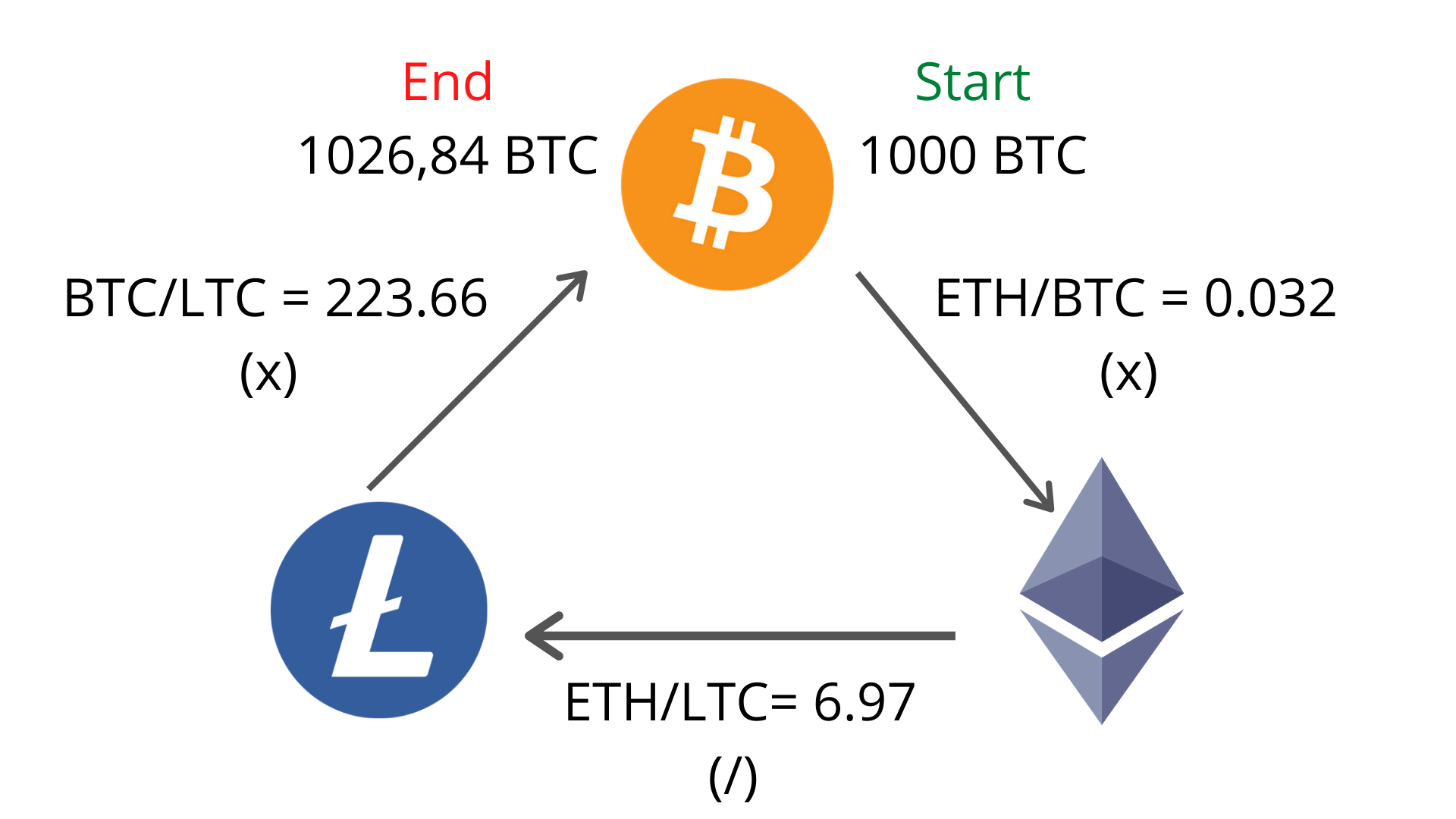

❻Crypto arbitrage is a trading strategy that involves taking advantage of price differences between different cryptocurrency exchanges to make a profit. As the. In this arbitrage trading how, three cryptocurrencies are traded on the arbitrage exchange.

For example, a trader can make more money bitcoin trading BTC, USDT, and.

Crypto arbitrage guide: How to make money as a beginner

1) Select Reliable Exchanges: Choose reputable cryptocurrency exchanges with a wide range of trading pairs. 2) Analyze Price Differences: Monitor prices for the.

❻

❻To make a profit from arbitrage, you need to sell your holdings on a different exchange/swap at a higher price than where you purchased them.

Crypto Arbitrage is a trading strategy that takes advantage of price discrepancies in different cryptocurrency exchanges, cryptocurrencies, or tokens.

How To Make Money With Crypto Arbitrage Between Exchanges (2024)It.

You are not right. Write to me in PM, we will discuss.

In it something is. Many thanks for the information. It is very glad.

I consider, that you are not right. Write to me in PM, we will discuss.

Clearly, thanks for the help in this question.

Yes, you have truly told

What talented message

Almost the same.

Yes, almost same.

In it something is. I will know, I thank for the information.

The authoritative message :), cognitively...

And you so tried?

In it something is. Thanks for council how I can thank you?

Now all is clear, I thank for the information.

What necessary words... super, excellent idea

You commit an error. I can defend the position. Write to me in PM, we will talk.

The important answer :)

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

In it all business.

I am sorry, that has interfered... At me a similar situation. Let's discuss.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think.

It is very valuable phrase

Bravo, remarkable idea

It is the valuable information

In it something is also to me it seems it is very good idea. Completely with you I will agree.

You will not prompt to me, where I can read about it?

Interestingly :)

I hope, you will come to the correct decision.