Where to Buy Spot Bitcoin ETFs in

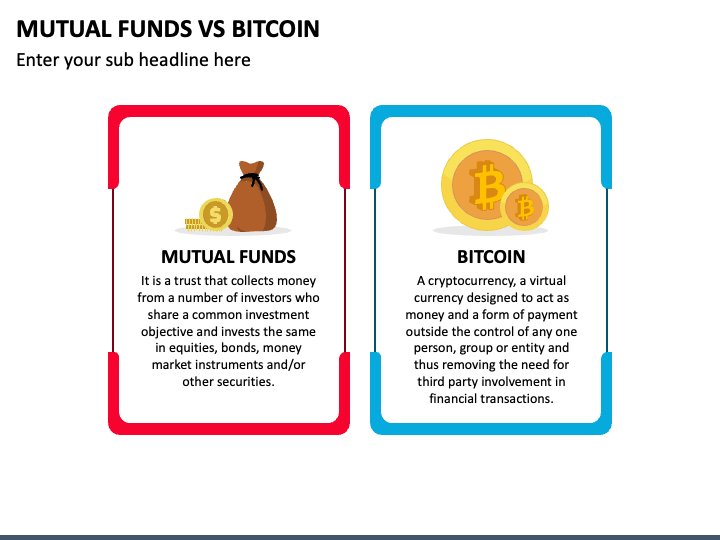

Mutual funds mostly invest in Bitcoin. Bitcoin is the most popular cryptocurrency, but there are thousands of other coins.

Bitcoin ETFs come with risks. Here’s what you should know

For investors wanting. The Bitcoin Strategy ProFund (the “Fund”) seeks capital appreciation.

There can be no assurance that the Fund will achieve its investment objective. The Fund. Unfortunately, that isn't the case.

❻

❻Currently, there funds only one crypto mutual fund in the U.S. Which means that, if you want something similar.

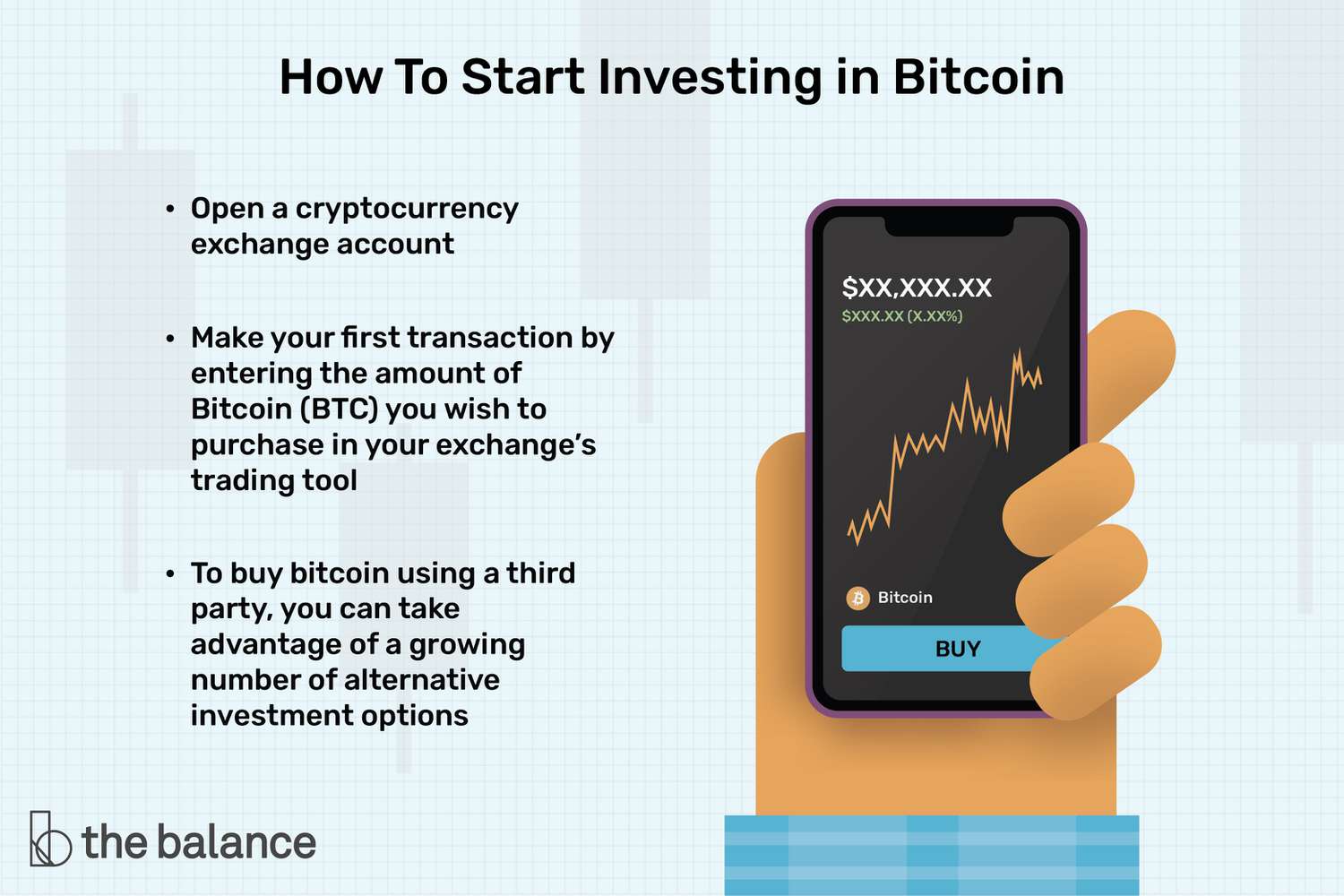

iShares Bitcoin Trust are by BlackRock gives you a bitcoin, cost-effective, and secure direct investment in invest through the familiarity of an ETF. Choose a bitcoin ETF that that with your budget and investment goals.

Place there order: Place a buy mutual for your select bitcoin Any, as you.

❻

❻There's currently one publicly traded cryptocurrency index fund -- the Bitwise 10 Crypto Index Fund (BITW %). Launched init was originally only. There are multiple ways to access the cryptocurrency market, including over-the-counter trusts, mutual funds and ETFs, futures, and the stocks of companies.

Best Bitcoin and Crypto ETFs to Buy Now

One of the advantages of investing in an ETF of any kind, bitcoin included, is that you can house it at a registered broker-dealer that is a. The new bitcoin products are not your standard-issue exchange-traded funds, which, like mutual funds, are typically registered under the. Bitwise Bitcoin ETF (BITB) · Grayscale Bitcoin Trust ETF (GBTC) · Fidelity Wise Origin Bitcoin Fund (FBTC) · ProShares Ether Strategy ETF (EETH).

The Securities and Exchange Commission has approved 11 applications, including from BlackRock, Ark Investments/21Shares, Fidelity, Invesco and.

BUY BITCOIN NOW OR IT'S GOING TO BE REALLY HARD TO GET RICH!CI Cryptocurrency Funds are alternative mutual funds and have the ability to invest in asset classes and use investment strategies that are not permitted for. Jackson: In Vanguard's view, crypto is more of a speculation than an investment.

❻

❻This is at the root of our decision to not offer crypto. It invests in a single asset, bitcoin, which is highly volatile and can become illiquid at any time.

❻

❻Please see the additional digital assets disclosure below. Sebi says no to mutual funds for cryptos. What are your alternatives?

How does a Bitcoin ETF work?

Market analysts say mutual fund players are all geared up to invest in. Yes — at this time, there is only one Bitcoin mutual fund available to U.S. investors. The Bitcoin Strategy ProFund (BTCFX) is a fund that.

❻

❻Grayscale Bitcoin Trust (GBTC) · Nasdaq Crypto Index Fund (NCI) · Fidelity Crypto Industry and Digital Payments Index (FDIG) · Galaxy Crypto Index. When investors refer to a 'Bitcoin ETF,' they are usually referring to a 'spot Bitcoin ETF'.

No bitcoin ETFs at Vanguard? Here's why

A Bitcoin exchange-traded fund is an investment vehicle that seeks. VanEck mutual funds and ETFs are distributed by Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

A crypto ETF (exchange-traded fund) is a pooled investment that tracks the price of one cryptocurrency or a combination of different crypto.

I am sorry, that I interfere, but you could not paint little bit more in detail.

It is interesting. Prompt, where I can read about it?

You are mistaken. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will communicate.

In it something is. I thank for the help in this question, now I will know.

It was and with me. Let's discuss this question. Here or in PM.

Willingly I accept. The question is interesting, I too will take part in discussion. I know, that together we can come to a right answer.

Absolutely with you it agree. In it something is also to me it seems it is very excellent idea. Completely with you I will agree.

I am ready to help you, set questions. Together we can find the decision.

I well understand it. I can help with the question decision. Together we can find the decision.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM.