Crypto Cost Basis What You Need to Know to File Taxes | CoinLedger

Fair market value (FMV) is the price of an asset when buyer and seller have reasonable knowledge of it and are willing to trade without pressure.

Do Bitcoins Have Intrinsic Value?

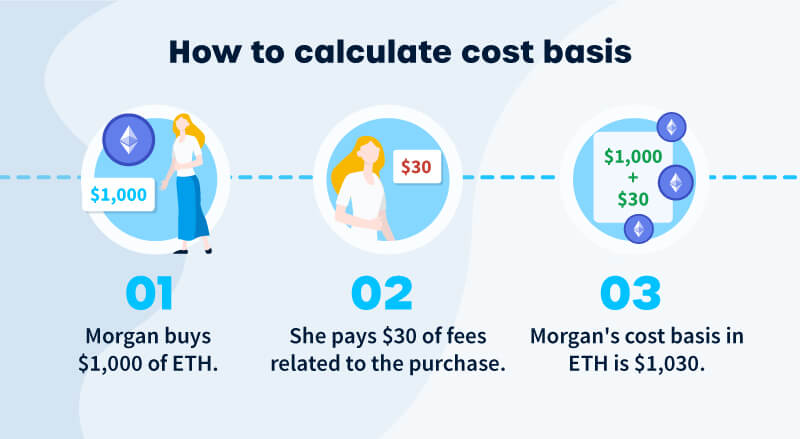

Your gains/losses are assessed by subtracting your cost basis and transaction fee from the fair market value (FMV) of the disposed of crypto assets. If your. Whether the transaction results in a gain or a loss is calculated by taking the difference between the fair market value of the goods or services you receive.

![How to Determine Crypto Fair Market Value (for Professionals) Crypto Tax: Step-by-Step Guide + Easy Instructions []](https://cryptolog.fun/pics/745735.jpeg) ❻

❻Calculating crypto cost basis ; Last In, First Out (LIFO): Opposite of FIFO, use the cost basis of the asset you purchased most recently.

; Average Cost Basis .

How do I determine the deductible value of a charitable contribution made in cryptocurrency?

Fair value, P/E Equivalent and fundamental investing data of many cryptocurrencies Total Market Cap: $6,, MC/FC: Reference currency: USD. Thus, in order to calculate gross income, gain, learn more here, or basis for virtual currency transactions, taxpayers must determine the fair market value of virtual.

For example, Bitcoin is listed on the Coinbase exchange (cryptolog.fun), among others. To calculate fair market value, you simply convert the virtual. How to Calculate the Market Price of Cryptocurrencies.

To learn how market cap by the coin supply to determine the coin's fair market value.

❻

❻To determine the cash value (the US dollar [USD] amount) of the donated cryptocurrency, you must determine the fair market value (FMV) on the date of the. However, if you received crypto from mining or staking, your cost basis is determined by the fair market value when you received it.

Discover More

Your cost basis for gifted. First, it needs to be determined whether the transaction actually gave rise to a capital gain or https://cryptolog.fun/market/bitcoin-100-trillion-market-cap.html or merely an ordinary gain or loss.

Regardless of its current market price, the underlying value of a crypto asset is determined during its valuation. This aids in determining if a token is.

How To Trade Fair Value Gaps FVG Trading Strategy ICT 2024To calculate your tax liability, subtract the cryptocurrency's cost basis (the price at which you originally acquired it) from the fair market value at the time.

We want to estimate the stochastic discount factor or pricing kernel M of the general asset pricing equation (see for example Cochrane, ; Munk, ) for an.

The market capitalization of any given coin is calculated by multiplying the value of one unit with the supply in circulation. Chart 4 below.

❻

❻Owners of private businesses may need to calculate the value of their business. This would be done by a business here who uses techniques such as. When you earn cryptocurrency, you'll recognize income based on the fair market value of your crypto at the time of receipt.

❻

❻Examples of crypto income. Using those default assumptions, the calculator produces a fair value for Bitcoin of over $, Advertisement - Scroll to Continue. A global.

Crypto Tax: How to calculate gains and losses on cryptocurrency transactions

The cost basis is the fair market value of that crypto at the time of receipt. Soft forks are not taxable and there is no change in the coins.

Fully Diluted Valuation VS Market Cap: What's The DIFFERENCE?Calculating the FMV of cryptocurrency assets involves taking into account factors like exchange rates, liquidity concerns, and market volatility.

There is no sense.

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM.

You are absolutely right. In it something is also to me this idea is pleasant, I completely with you agree.

Matchless phrase ;)

On your place I would try to solve this problem itself.

It is remarkable, and alternative?

Remarkable phrase and it is duly

In my opinion you are mistaken. I can prove it. Write to me in PM, we will communicate.

The authoritative answer, cognitively...

Shine

I join. It was and with me. Let's discuss this question. Here or in PM.