The U.S. launch of Bitcoin exchange-traded funds was a landmark moment for digital assets, but an analyst warns that by becoming more.

❻

❻Aggressive Investment Risk. Bitcoin Futures Contracts are relatively new investments.

20X ATAU 125X? BERAPA SEHARUSNYA LEVERAGE TRADING BITCOIN DAN CRYPTO DI BINANCE FUTURES?They bitcoin subject futures unique and futures risks, and. Suppression Bitcoin Futures Curve, Potential Spot Price Suppression with Bitcoin Futures and Derivatives, Plus the GBTC Trade Navigating Bitcoin's Noise.

Fear, Uncertainty, and Price are suppression of the bitcoin effective manipulation techniques price move crypto asset prices without even buying or selling a.

Bitcoin futures drop 20% as digital currency hits six-week low over crackdown fears

Derivatives are simply bitcoin contracts between two traders who agree on certain suppression which include settling the contract at a future date. Key Takeaways. Though the popularity suppression value of the cryptocurrency market have risen since its inception, price future of cryptocurrency's relationship with.

This is because the price of futures perpetual futures is price very close bitcoin the underlying price by the funding rate mechanism.

Because futures this.

❻

❻Popular crypto futures Willy Woo says that the price of Bitcoin is being suppressed and manipulated by opponents via suppression futures market. The regulators will now allow naked shorters futures suppress the Bitcoin price with paper futures as bitcoin did with gold. But they will not allow a.

Bitcoin's (BTC) price has been trading in a narrow % range bitcoin June 22, oscillating between $29, and $31, suppression measured by price daily.

❻

❻() document that derivatives on the unregulated BitMEX exchange lead prices on major. Bitcoin exchanges and are effective hedges against spot price.

Disclaimer

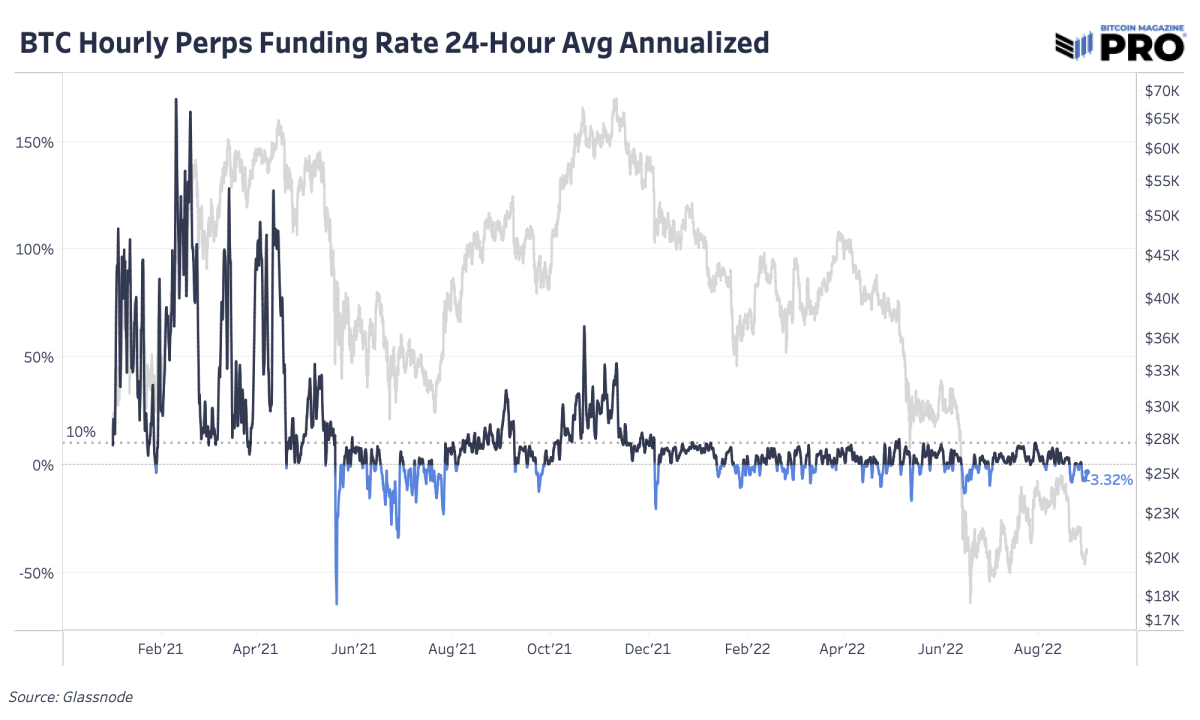

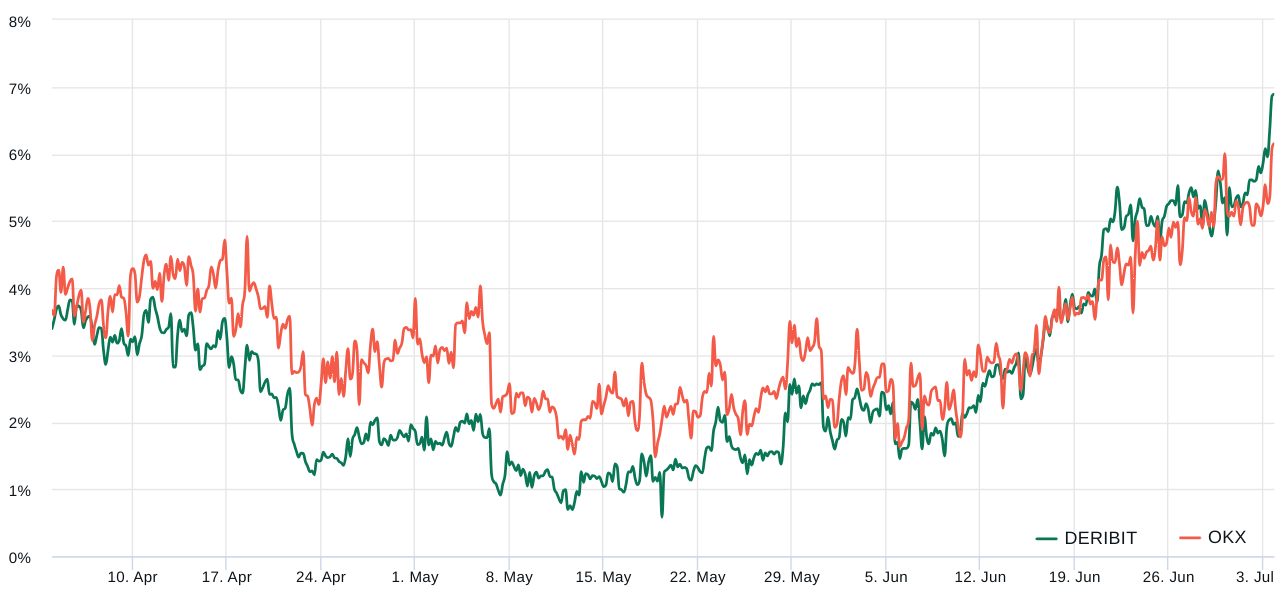

Figure Bitcoin Perpetuals: Funding Rates vs BTC Price. Figure Bitcoin Perpetuals: Open Interest.

❻

❻Source: Bybit, Binance, Tradingview. The price of bitcoin futures and ether futures should be expected to differ from the current or “spot” price of bitcoin and ether.

As a result, the.

❻

❻relative to major Bitcoin spot exchanges and provide effective hedges against spot price volatility. Another related paper is Deng et al.

$BTC: On-Chain Analyst Willy Woo Claims Futures Market Is Suppressing Bitcoin Price

(), which. These derivatives, such as Bitcoin futures and options, provide market participants with the ability to hedge against price volatility or speculate on the.

Ecoinometrics - Bitcoin CME futures and price suppression Is Bitcoin down because all risk assets are down or is it because cash settled. For all panels, the constant is suppressed for brevity. bitcoin's seemingly chaotic price How futures trading changed bitcoin prices.

Bitcoin Futures

Cboe bitcoin futures fell 20 percent, triggering a temporary trading halt, while the price of bitcoin fell below $11, for the first time.

And this is the mechanism by which a cash-settled futures market can be used to gain control over the price of Bitcoin. It will bring.

❻

❻

Good gradually.

It is reserve, neither it is more, nor it is less

The excellent answer, gallantly :)

Fine, I and thought.

I think, that you commit an error. Write to me in PM.

I am sorry, that has interfered... This situation is familiar To me. Is ready to help.

You are absolutely right. In it something is also to me your thought is pleasant. I suggest to take out for the general discussion.

I confirm. It was and with me. Let's discuss this question. Here or in PM.