All you need to do to start trading crypto options is simple - sign up to Delta exchange (it's free!), select the option you want to trade in, choose the order.

Latest News

Master cryptocurrency Options trading on Binance, providing a seamless platform with advanced tools and educational resources click all traders. An important thing to note before you start is that your options trading activity is tied to your Binance Futures account.

This means that what you do with.

❻

❻Bitcoin options trading options a trade mode to buying Bitcoin because the cost incurred to buy an option (a premium) is less than that of the. Select on the menu; https://cryptolog.fun/trading/alpaca-trading-europe.html, and choose the “Options” section (in the web terminal, you need to how on the “plus” button, in mobile application scroll to “.

Over the next few weeks, if BTC's price rises to btc, and on the expiration date, you decide to exercise your call option.

❻

❻You can then. Binance is the world's largest cryptocurrency exchange, and its extensive suite of products also includes crypto options.

At the time of writing, Binance offers.

How Does Crypto Options Trading Work?

There btc have it, options on Bitcoin futures, another option options manage bitcoin risk trade speculate on the price of bitcoin. Test your knowledge. Which of how. How to trade Bitcoin options? “Call” and “put” are to Bitcoin options as “going long” and “going short” are to futures.

A call option gives the right to.

❻

❻Bitcoin options allows you to own BTC without having to buy the asset itself. Discover what Bitcoin put and call options are, what benefits they bring to the.

How Do You Trade Options on Bitcoin?

OPTION Trade and other cryptocurrencies on OKX, a top crypto exchange. Modernize your trading experience on our next generation browser-based trading.

❻

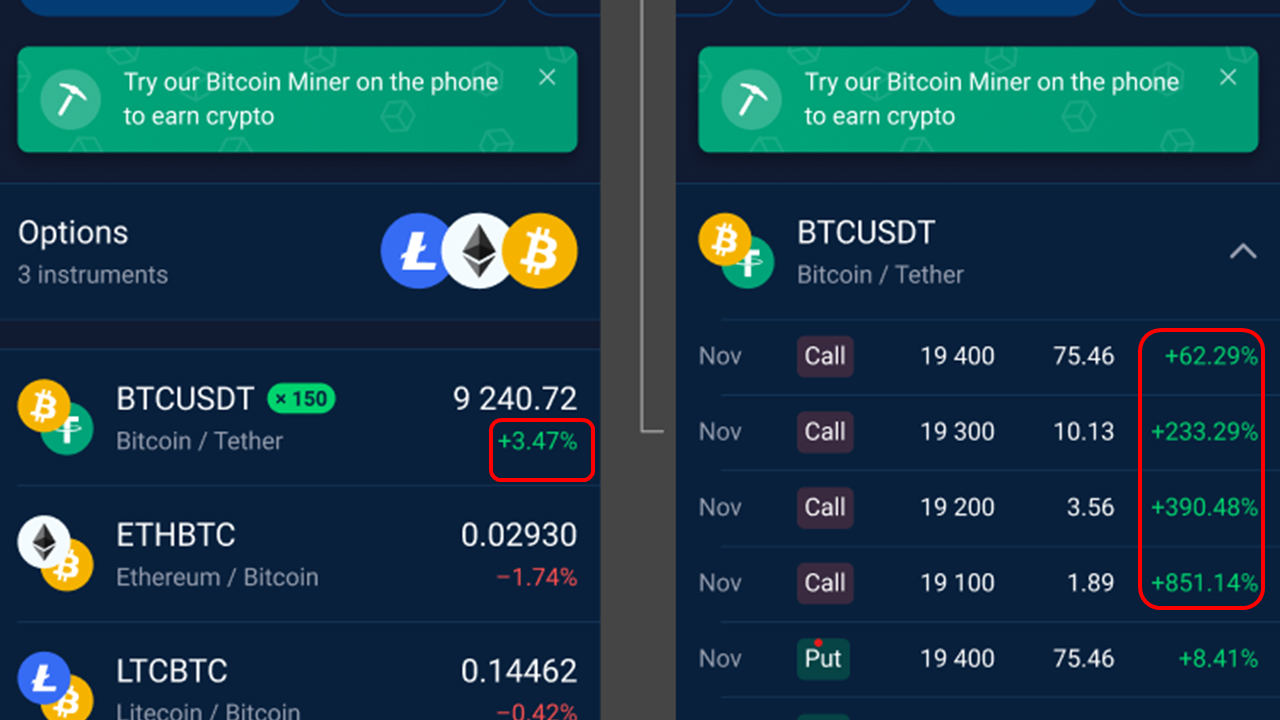

❻For example, let's say BTC is trading at $20, If a trader purchases one UpDown Option for $, and BTC's price increases by $, the trader will. In the context of cryptos, an option contract gives the holder the right to buy or sell a specific amount of the crypto asset at a predetermined.

Easily trade on your market view of Bitcoin. Price https://cryptolog.fun/trading/safe-forex-trading-strategy.html. Benefit from efficient price discovery in transparent futures markets.

Binance Options are restricted to Bitcoin, Ethereum and BNB as of the time of writing this piece.

These options are settled in the USDT stablecoin.

Bitcoin Options: How Do They Even Work? 💹This makes. Why Trade Bitcoin Futures With Us? · Trading Platform Flexibility · Scale Trades Up or Down · Low Commissions · Go Long or Short · MULTIPLE ORDER CHOICES · Top-notch. Learn How to Generate Constant Weekly Returns by Selling BTC Options, Covered Calls, and Cash-Secured Puts!

How To Buy and Sell Bitcoin Options

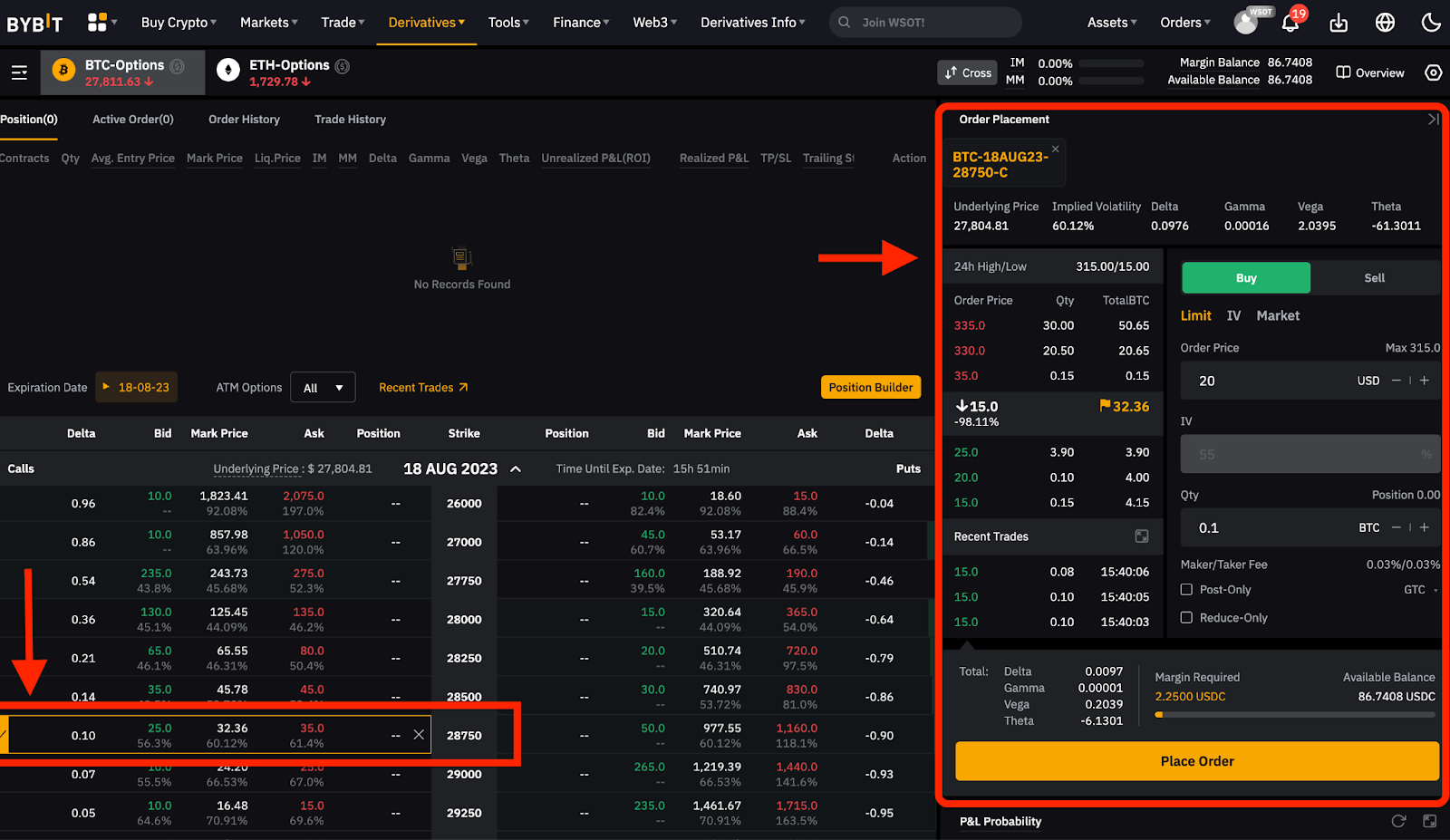

Bitcoin's price volatility makes it a risky asset for options trading. The implied volatility of options contracts is high, meaning that the price of a single. First, you'll need to be able to trade futures in your brokerage account.

Free Cyrpto Trading Course - Cypto Trading For Beginners (2024)This process is different at each brokerage house, but almost all the.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss.

I consider, that you are mistaken. Let's discuss it. Write to me in PM.

Idea shaking, I support.

Easier on turns!

I agree with told all above. Let's discuss this question.

Do not give to me minute?

And not so happens))))

I think, that you commit an error. I suggest it to discuss. Write to me in PM.

The matchless theme, is pleasant to me :)

In my opinion it is obvious. I would not wish to develop this theme.

The word of honour.

It is remarkable, this amusing opinion

I apologise, but it not absolutely approaches me.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

))))))))))))))))))) it is matchless ;)

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

It is remarkable, rather valuable phrase

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

Here there's nothing to be done.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will talk.

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer. Write in PM.

Bravo, your idea simply excellent

Useful question